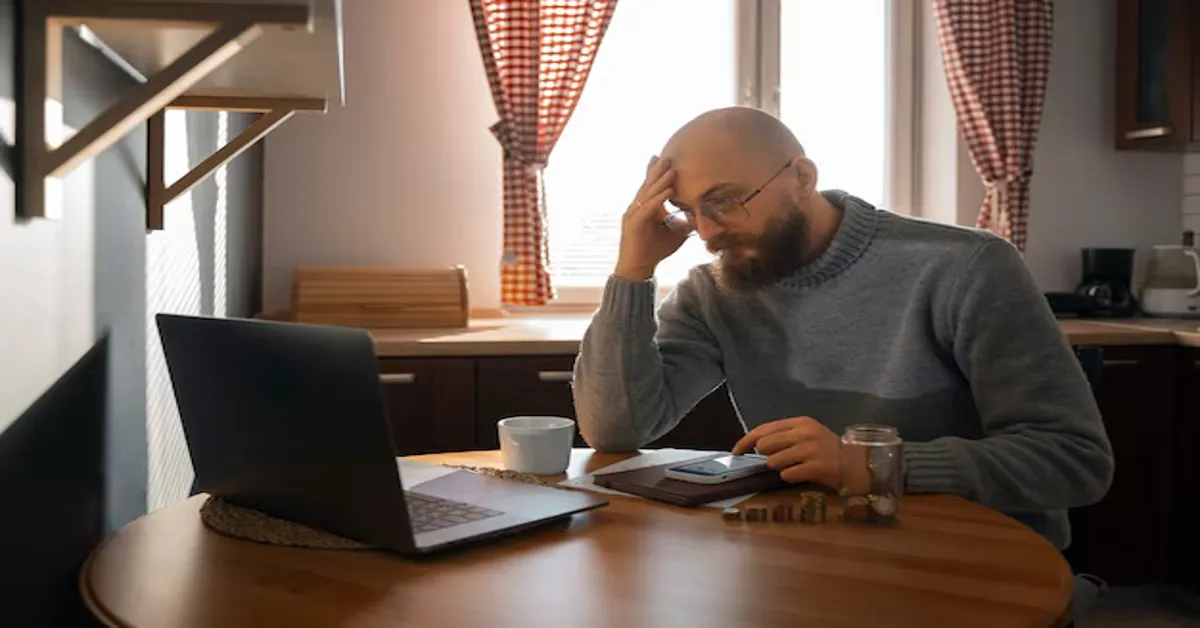

When discussing financial agreements, many people immediately think about numbers and contracts. However, the effects of financial decisions extend far beyond paperwork—they shape our daily lives, influencing everything from travel plans to family stability and overall well-being. PCP claims have become a topic of growing concern, as many individuals realize they may have been misled into unfavorable agreements. Addressing these issues not only helps in recovering funds but also brings financial clarity, enabling better decisions in key areas of life, including health, leisure, and family commitments.

Understanding PCP Claims Beyond Car Finance

A PCP claim arises when someone believes they were mis-sold a car finance agreement, often due to hidden fees, misleading terms, or affordability issues that were not properly assessed. While these disputes primarily fall under the financial sector, their consequences can be felt in personal areas of life, affecting budgets for travel, health-related expenses, and quality time with loved ones.

For example, someone dealing with an unexpected financial burden from a mis-sold agreement might have to cancel a planned vacation or cut back on lifestyle choices. This highlights why addressing car finance claims isn’t just about money—it’s about reclaiming financial stability and ensuring that unexpected costs do not disrupt personal goals and well-being.

Financial Burdens and Their Impact on Travel

Travel is often a way to unwind, explore new cultures, and create lasting memories with family and friends. However, financial uncertainty can put a hold on these experiences. If a person is unknowingly overpaying due to a mis-sold car finance claims agreement, their ability to save for travel is directly affected.

Consider someone who planned an international trip but had to redirect their funds to cover unexpected payments on a vehicle agreement they didn’t fully understand. This situation is more common than many realize, making it essential for consumers to review their contracts and ensure they are not being unfairly charged. Successfully handling a PCP claim could free up much-needed resources, allowing individuals to resume their travel aspirations without added stress.

How Car Finance Claims Affect Lifestyle and Well-being

Lifestyle choices, from recreational activities to health and fitness, often rely on a well-managed budget. When unexpected financial burdens arise, people are forced to adjust their spending habits. Mis-sold car finance claims can disrupt financial plans, limiting access to things that contribute to a balanced and enjoyable life.

For instance, regular gym memberships, wellness retreats, and even simple self-care routines might be sacrificed when extra payments become a concern. Financial anxiety can also take a toll on mental well-being, leading to stress and burnout. Addressing PCP claims helps alleviate these concerns by ensuring that individuals are only paying what they rightfully owe, enabling them to allocate their money toward healthier and more fulfilling pursuits.

The Family Aspect: Creating Stability Through Financial Awareness

A stable financial situation is one of the most important elements of a happy family life. Parents, in particular, want to provide the best opportunities for their children, whether through education, extracurricular activities, or family vacations. When mis-sold financial agreements create unexpected expenses, these goals can be affected.

Take, for example, a family that intended to enroll their child in a specialized educational program but had to reconsider due to unexpected vehicle payments. This is where being proactive with PCP claims can make a difference. By identifying financial discrepancies and reclaiming mis-sold funds, families can maintain stability and ensure their financial plans remain intact.

Additionally, teaching financial awareness within the family unit is essential. Parents who take action against unfair car finance claims set an example for their children, demonstrating the importance of reviewing financial agreements and advocating for consumer rights. These lessons in financial literacy can benefit future generations, helping them make informed decisions as they navigate their own financial journeys.

Financial Recovery: Taking Control of Your Future

If you suspect that your car finance claims agreement was mis-sold to you, it is crucial to take action. Many consumers are unaware that they may be eligible for compensation or contract renegotiation. Reviewing your agreement, seeking professional advice, and filing a PCP claim if necessary can lead to financial recovery and peace of mind.

Addressing these claims not only rectifies financial losses but also restores the ability to plan effectively. Whether it’s putting money back into a travel fund, investing in personal health, or ensuring that family priorities are met, resolving financial discrepancies opens the door to a more secure future.

Conclusion

While PCP claims may seem like a niche financial issue, their impact extends into crucial areas of life such as travel, health, and family well-being. Ensuring that financial agreements are fair and transparent allows individuals to focus on what truly matters—building experiences, maintaining a fulfilling lifestyle, and securing a stable future for their loved ones.

By taking control of car finance claims, consumers not only safeguard their finances but also empower themselves to make choices that enrich their lives. Financial clarity is not just about numbers; it’s about creating opportunities for growth, wellness, and happiness.