I remember how quickly the phrase “Biden stimulus” entered everyday conversations, not as an abstract policy but as a question families asked each other at kitchen tables. Was it approved. How much would arrive. And what would it actually change. In the first hundred words of any search about the plan, readers want clarity. What was passed, when it was approved, and why it mattered so much. – https://finanzasdomesticas.com/plan-de-estimulo-joe-biden-aprobado.

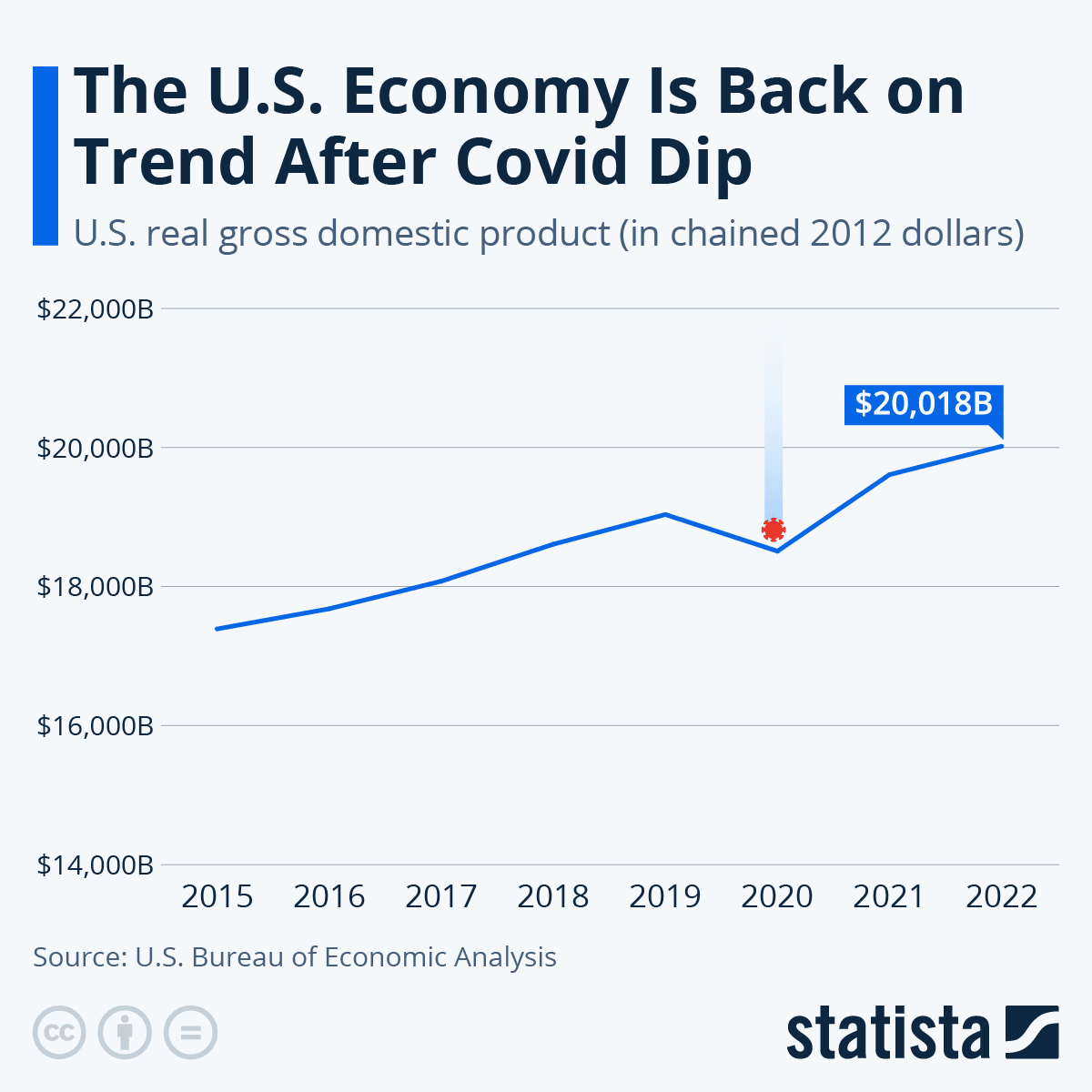

The answer begins in early 2021, when the United States was emerging from the deepest economic shock since the Great Depression. Millions were unemployed, schools were disrupted, and state budgets were strained. In March 2021, President Joe Biden signed the American Rescue Plan into law, authorizing roughly 1.9 trillion dollars in stimulus spending. The vote marked one of the most ambitious federal interventions in modern American history.

This article explains what the stimulus plan included, how it moved through Congress, and how it affected households, businesses, and local governments. I look beyond headlines to examine outcomes, tradeoffs, and debates that continue years later. From direct payments and expanded unemployment benefits to child tax credits and public health funding, the plan reshaped economic expectations.

Understanding the Biden stimulus is not only about revisiting a crisis response. It is about seeing how government action can alter inequality, stabilize markets, and redefine the relationship between citizens and the state in moments of national stress.

The Political Moment Behind the Stimulus

The stimulus did not emerge in a vacuum. When Joe Biden took office in January 2021, the economy was improving but fragile. Vaccines were rolling out, yet consumer confidence lagged. Democrats controlled Congress by the narrowest margins, creating urgency and risk.

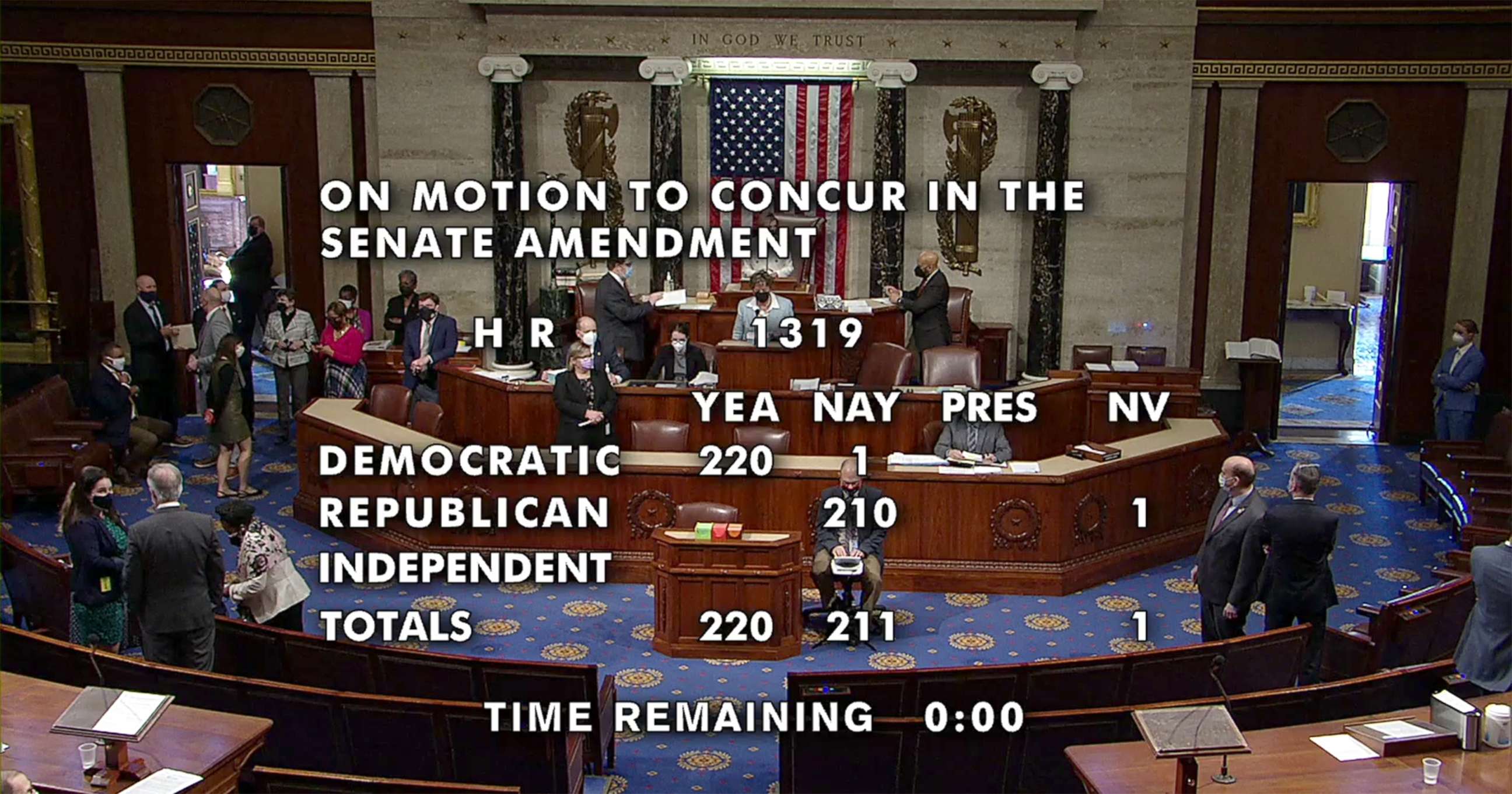

The plan moved through Congress under budget reconciliation, allowing passage with a simple majority. No Republican lawmakers ultimately voted for it. Supporters argued speed was essential. Critics warned of inflation and excessive spending.

Political historians often describe the vote as a turning point. It signaled a willingness to use federal power aggressively, echoing New Deal era logic. The decision shaped Biden’s early presidency and framed economic debates that followed. – https://finanzasdomesticas.com/plan-de-estimulo-joe-biden-aprobado.

What the Biden Stimulus Plan Included

At its core, the plan combined immediate relief with medium term support. Most Americans remember the direct payments. Eligible individuals received up to 1,400 dollars, with additional amounts for dependents. For many households, this was the third stimulus check since 2020.

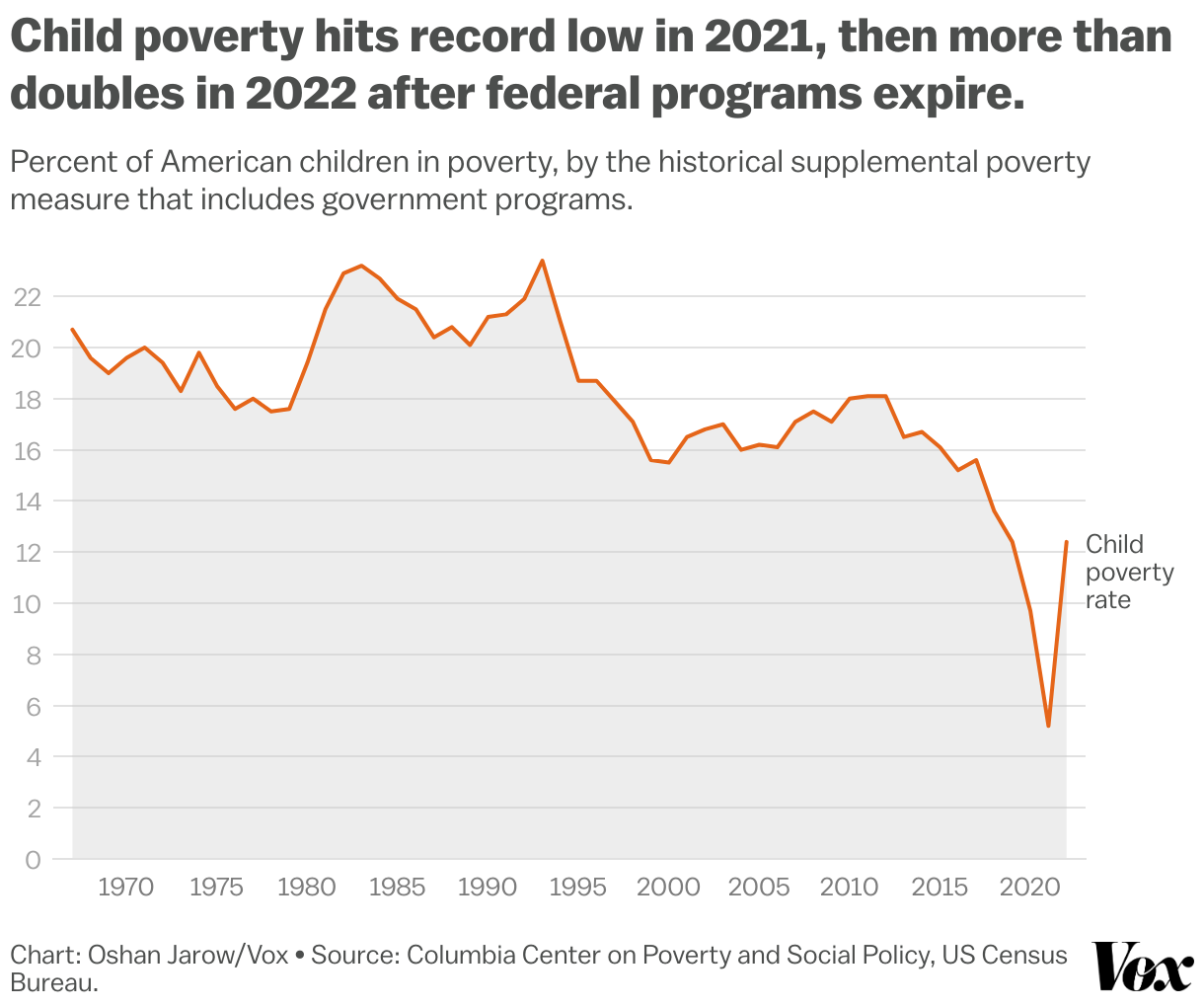

Unemployment benefits were extended and supplemented, while renters received eviction protections. The plan also expanded the Child Tax Credit, sending monthly payments to families, a change that significantly reduced child poverty in 2021.

Beyond households, billions flowed to state and local governments, schools, transit systems, and public health agencies. The breadth of spending reflected an understanding that recovery depended on institutions as much as individuals. – https://finanzasdomesticas.com/plan-de-estimulo-joe-biden-aprobado.

Key Components of the American Rescue Plan

| Area | Allocation | Purpose |

|---|---|---|

| Direct Payments | Approx. $410B | Immediate household relief |

| Unemployment Aid | Approx. $240B | Income support |

| Child Tax Credit | Approx. $100B | Reduce child poverty |

| State and Local Aid | Approx. $350B | Prevent layoffs and cuts |

| Public Health | Approx. $160B | Vaccines and testing |

Direct Payments and Household Impact

Direct payments were the most visible part of the plan. For lower income households, the checks covered essentials like rent, food, and utilities. For others, they reduced debt or boosted savings.

Economists studying transaction data found that spending increased sharply after payments were distributed, particularly in sectors like groceries and durable goods. This surge helped stabilize businesses still operating under pandemic constraints.

Critics argued that some payments went to households that did not need them. Supporters countered that broad distribution ensured speed and simplicity, preventing administrative delays that often undermine targeted programs. – https://finanzasdomesticas.com/plan-de-estimulo-joe-biden-aprobado.

Read: Protocolo Operacional Padrão Meaning, Definition, Purpose, and Practical Importance Explained

The Expanded Child Tax Credit

The expansion of the Child Tax Credit may be the plan’s most consequential social policy element. For the first time, families received monthly payments rather than a single annual credit. Eligibility widened, and payments increased.

Research from Columbia University later showed child poverty fell dramatically in 2021. Parents reported using the funds for childcare, education, and nutrition. The policy reframed how Americans thought about family support. – https://finanzasdomesticas.com/plan-de-estimulo-joe-biden-aprobado.

However, the expansion expired in 2022, reigniting debates about cost, work incentives, and permanence. Its short lifespan remains one of the plan’s most contested legacies.

State and Local Government Relief

Another pillar of the stimulus was aid to states and municipalities. During earlier recessions, budget shortfalls forced layoffs and service cuts. This time, federal funds aimed to prevent that cycle.

Governors and mayors used the money to stabilize payrolls, fund infrastructure, and maintain public services. The result was a faster recovery in public sector employment compared to previous downturns.

Fiscal experts note that this support helped avoid a drag on national recovery, even as it raised questions about long term federal obligations.

Timeline of Approval and Implementation

| Date | Event | Significance |

|---|---|---|

| Jan 2021 | Biden inauguration | Policy shift |

| Feb 2021 | House passage | Party line vote |

| Mar 2021 | Senate approval | Reconciliation used |

| Mar 11, 2021 | Signed into law | Implementation begins |

Inflation and Economic Debate

By late 2021 and 2022, inflation surged, prompting critics to link rising prices to stimulus spending. Energy costs, supply chain disruptions, and global factors also played roles, complicating attribution. – https://finanzasdomesticas.com/plan-de-estimulo-joe-biden-aprobado.

Some economists argue the scale of the plan overheated demand. Others contend inflation would have risen regardless, given pandemic shocks and geopolitical events.

Federal Reserve officials later acknowledged fiscal stimulus as one factor among many. The debate underscores how crisis policy decisions echo long after emergencies fade.

Expert Perspectives on the Stimulus

A Brookings Institution economist described the plan as “insurance against a weak recovery.” A former Treasury official called it “a calculated risk that prioritized speed over precision.” Meanwhile, a labor economist highlighted its role in reducing inequality during a vulnerable period.

These perspectives reflect enduring disagreement, yet they share recognition of the plan’s scale and ambition. Few deny it reshaped the trajectory of recovery.

Long Term Legacy of the Biden Stimulus

Years later, the stimulus remains a reference point in policy debates. It influenced later investments in infrastructure and industrial policy. It also reshaped expectations about government responsibility during crises.

For supporters, it proved that aggressive action can prevent prolonged hardship. For critics, it stands as a cautionary tale about debt and inflation. Its true legacy likely lies between those poles.

Takeaways

- The Biden stimulus was approved in March 2021 during acute economic stress

- Direct payments provided rapid household relief

- The Child Tax Credit expansion significantly reduced child poverty temporarily

- State and local aid prevented public sector layoffs

- Inflation debates continue to shape its evaluation

- The plan redefined expectations of federal crisis response

Conclusion

I see the Biden stimulus as both a product of crisis and a marker of change. It emerged from urgency, yet it reflected evolving ideas about inequality, risk, and government capacity. For millions, the benefits were tangible and immediate. For policymakers, the consequences were complex and long lasting.

The plan did not solve every problem, nor did it escape criticism. But it altered the recovery’s shape, shortening the downturn and cushioning its worst effects. As future crises arrive, this episode will inform decisions about scale, speed, and scope.

Understanding the stimulus today means recognizing its human impact alongside its economic footprint. It stands as a reminder that policy is not only numbers on a ledger, but choices that ripple through everyday life.

FAQs

When was the Biden stimulus approved

It was signed into law on March 11, 2021.

How much was the stimulus package worth

Approximately 1.9 trillion dollars.

Who received direct payments

Most U.S. residents under income thresholds, including dependents.

Did the stimulus cause inflation

Economists say it contributed but was not the sole cause.

Is the Child Tax Credit expansion still active

No, it expired in 2022.