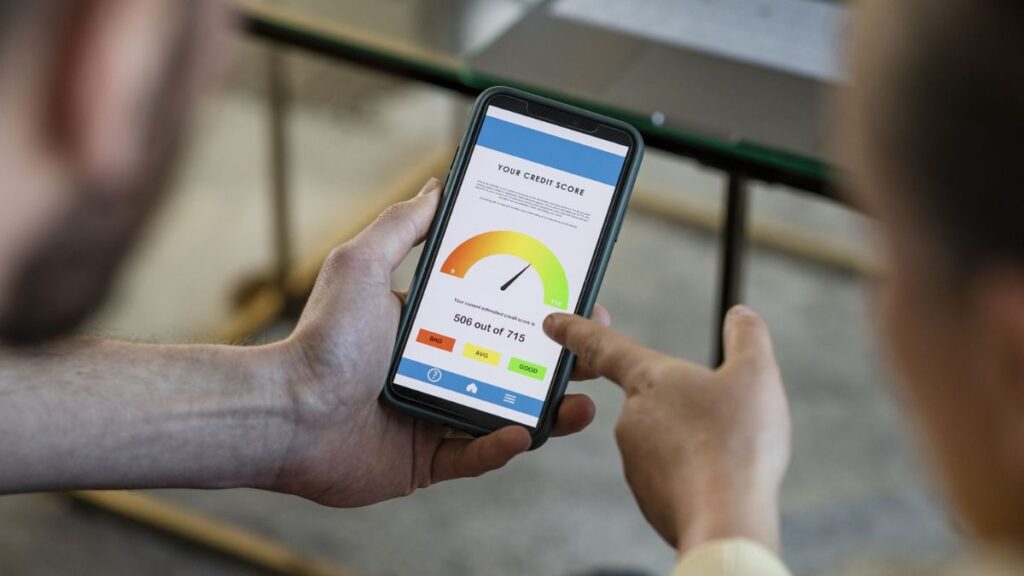

Nowadays, financial health doesn’t just mean saving money or making smart investments; it also means understanding and taking care of your credit. A credit score, which is often just a number that doesn’t seem to mean much, has a huge impact on many parts of our lives.

For many people, it’s a deciding factor when it comes to getting loans, renting homes, or even getting some jobs. Because it has so many effects, it’s important to not only know what your credit score is but also to check it often. Why is this so important?

Stay tuned for more, folks.

The Role of Credit Score in Getting a Loan

The first step is to understand how important a credit score is, especially when it comes to getting loans. Lenders look at your credit history when you ask for any kind of credit, like a mortgage, a car loan, or a credit card, to figure out how reliable you are with money.

Think of your credit score as a grade on how you handle your money. High scores generally show that a person is financially responsible because they pay their bills on time, don’t go over their credit limits, and have a good mix of different types of credit. On the other hand, lower results can be red flags that indicate possible risks.

For lenders, this number is like a crystal ball that tells them how you might handle debts in the future. People with good scores usually get lower interest rates, bigger loan amounts, and better terms. On the other hand, if you have a bad score, you might have to pay very high-interest rates or not be able to get credit at all. Understanding this is the first reason why people need to keep an eye on their credit scores.

There are actually several reasons why it’s important to check your credit, and often! Here’s what you need to know:

Spotting Mistakes

Even though financial institutions are very careful, they can sometimes make mistakes. Maybe a payment you made wasn’t recorded properly, or maybe someone else’s information got mixed up with yours. If you don’t fix these problems, they can hurt your credit record. When you check your score often, you can find these mistakes and fix them before they get worse and hurt your score.

Keeping Your Identity From Being Stolen

Identity theft isn’t just a plot in a drama movie in this digital age; it’s a real and present danger. If thieves get their hands on your personal information, they can open new lines of credit in your name, spend a lot of money, and leave you with the bill.

A strange account or transaction on your credit record is often the first sign that something is wrong. By keeping track of things on a regular basis, you put yourself in a position to find these illegal activities early on, so you can take quick action to stop more damage.

Charting the Growth of Money

Life isn’t always the same, and neither are people’s finances. You may have had a rough time with money in the past, with missed payments or bills. But as you grow and learn better ways to handle your money, it’s encouraging to see your credit score go up. Regular checks can be a source of inspiration because they show you how your hard work is paying off.

Getting a Loan

We’ve already mentioned some of this above, but it’s a good idea to say it again. Knowing your credit score gives you the information you need to make good choices. You might be thinking about making a big purchase that will require a loan. Staying informed on your credit rating can help you decide if now’s a good time to apply for that loan or if you should wait and work on improving your score first.

Getting Ready for Life’s Big Events

Your credit score can make or break big events in your life, like buying a house, borrowing a new car, or even getting a job. Checking often gives you the ability to plan ahead. You won’t be caught off guard when things get tough because you know where you stand and what you might be eligible for.

Learn About the Things That Affect Your Score

Credit reports show you more than just your score. They also break down the things that affect your score. This could include things like how much credit is being used, the number of accounts, recent requests, and more. This better understanding can help direct what people do. For example, if your score is low because you use a lot of credit, you can fix the problem by paying down your bills.

Keeping Up-To-Date on Rights

When you look at your credit report, you are also told what your rights are when it comes to credit reports. This includes the right to dispute mistakes, find out who can see your report, and know when a credit reporting service can’t give your report to someone else. This kind of information can help you protect your own interests.

How to Check Credit Score Yourself?

Thanks to improvements in technology and changes in the law, it is now easier than ever to kredittsjekk deg selv as soon as possible. Here are some long-form tips to help you get ready to look at your financial report card.

Use Your Free Credit Report Every Year

In many countries, the law requires credit companies to give each person a free credit report once a year.

Go to the official site or call the credit bureau directly. Usually, you’ll need to give information about yourself. Once your report has been checked, you can look at it online or ask for a copy to be sent to you. Spreading out these free reports from different offices over the course of the year is a good idea. This way, you can keep an eye on your credit without having to pay for it.

Use Credit Monitoring Services

There are a number of third-party services that offer credit monitoring, and identity theft security is often included. Some services cost money, but many of the basic ones are free. These platforms give you regular updates on your credit score and let you know if there are any big changes or suspicious behavior.

Check With Your Bank or Credit Card Company

As a perk to their customers, many financial companies let people see their credit scores for free. This is becoming more and more frequent, especially among credit card companies. It’s an easy way to keep an eye on your score without having to sign up or go through extra steps.

Choose Paid Reports Once if You Want a Detailed Analysis

You can buy a one-time report if you’ve used up all your free reports for the year and want a more in-depth look, like before making a big financial decision. Most of the time, these paid reports come with a thorough breakdown, an analysis, and sometimes even consultation services to help people better understand the report.

Check to See if It’s Right and Argue if Necessary

When you check your credit report, make sure everything is correct, from your personal information to your account records. If you find differences, you need to fight them right away. If you make mistakes, it can hurt your score.

A Few Final Words

Knowing as much as possible about credit ratings is crucial in a world where they can affect so many steps of your financial journey.

Checking your score regularly isn’t just about numbers; it’s a proactive way to make sure your finances are healthy, spot possible problems, and plan for your future goals. With these tips in hand, you should be able to take control of your credit story.

ALSO READ: Unveiling the World of “intext:password ext:log” – A Comprehensive Guide