Having a credit card is essential for many people in today’s digital world. In terms of one’s personal money, it provides ease, safety, and adaptability. The fate Credit Card is unlike any other credit card on the market. Consumers who are looking to improve their financial situation have found the Destiny Credit Card to be a popular option because to its novel design, low interest rates, and generous rewards program. Discover the key to a better financial future with the fate Credit Card as we delve into its features, application, and commonly asked questions.

Understanding Credit Cards

Learn the fundamentals of credit cards before delving into the specifics of the fate Credit Card. A credit card is a revolving line of credit that can be used like cash for any purchase up to the card’s credit limit. They’re handy, good for your credit, and come with perks galore. It’s important to use credit cards, but only if you can afford to pay off your balance in full each month.

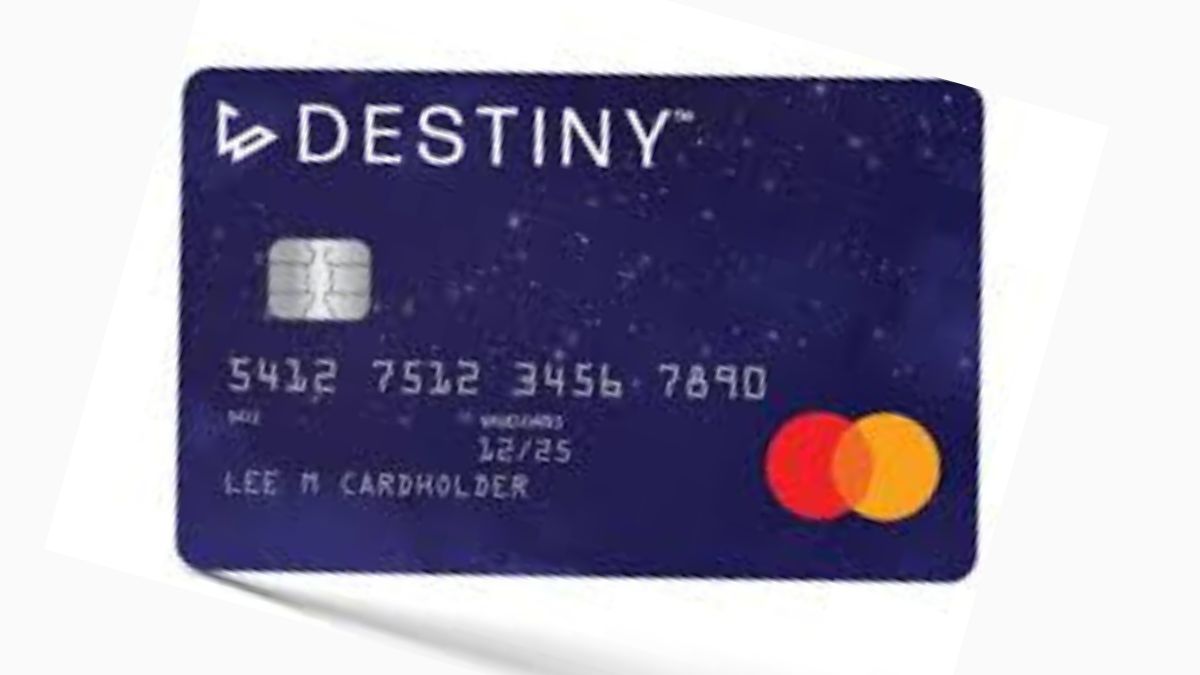

Introduction to the Destiny Credit Card

The fate Credit Card is a robust financial tool created to provide cardholders more freedom and flexibility in their financial lives. It’s provided by a prestigious bank that’s devoted to making life easier for its customers. The Destiny Credit Card offers a wide variety of helpful tools for handling regular purchases, unexpected costs, and saving for the future.

Benefits of the Destiny Credit Card

- Competitive Interest Rates: The fate Credit Card offers excellent interest rates, so you can properly manage your money and pay the least amount of interest possible.

- Rewards Program: Cardholders have access to a comprehensive rewards program designed specifically for them. Get points for everything you buy, and use them for freebies, discounts, and more.

- Enhanced Security: The Destiny Credit Card offers extra security with features like chip technology and fraud prevention so you can shop with confidence.

- Flexible Payment Options: The Destiny Credit Card gives you the freedom to pay in full or carry a balance, whichever is more convenient for your current financial circumstances.

- Additional Perks: Extra Benefits: Take advantage of unique advantages including price reductions, longer guarantees, and invitations to VIP-only sales and events.

How to Apply for the Destiny Credit Card

The procedure for obtaining a fate Credit Card is simple. If you want to reach your full economic potential, do as follows:

- Check out the Destiny Credit Card homepage for more information.

- To apply, please hit the “Apply Now” button.

- Provide your contact and financial details in the online application.

- Take a look over the application and send it in.

- The approval process is usually quick, so just wait.

- Your Destiny Credit Card will be delivered to your home after approval.

Managing Your Destiny Credit Card

If you’ve been issued a fate Credit Card, you should use it responsibly so that you can reap the rewards and minimize the risks. Here are some suggestions for responsible credit card use:

- Pay Your Bills on Time: Keep a good payment history and prevent late fees by always paying your bills on time.

- Monitor Your Expenses: Keep an eye on your spending: Review your credit card bills frequently to ensure their accuracy and keep track of your spending.

- Stay Within Your Credit Limit: Observe the Limits of Your Credit: If you want to keep your credit score from taking a hit and avoid paying over-limit penalties, you should avoid going over your credit limit.

- Set Up Account Alerts: Account Notifications: Payment reminders, alerts, and account updates can all be accessed via the online banking portal or mobile app.

- Contact Customer Support: Get in touch with the Help Desk: Get in touch with the helpful staff at Destiny Credit Card if you have any questions or issues.

Conclusion

Individuals looking for a credit card with amazing perks, competitive rates, and a rewarding experience may find the Destiny Credit Card to be an ideal option. You can improve your financial situation and open up new doors if you learn to take use of it in a responsible manner. If you want to take charge of your financial future, apply for a fate Credit Card today.

Frequently Asked Questions (FAQs)

Can I apply for the Destiny Credit Card if I have a limited credit history?

Yes, the Destiny Credit Card offers options for individuals with limited credit history. Contact the customer support team for more information.

What happens if I miss a payment on my Destiny Credit Card?

Missing a payment may result in late payment fees and potentially affect your credit score. It’s crucial to make timely payments to avoid such consequences.

Are there any annual fees associated with the Destiny Credit Card?

The fate Credit Card may have an annual fee, but it varies based on the specific card type and promotional offers. Refer to the terms and conditions for detailed information.

Can I redeem my reward points for cashback?

Yes, the Destiny Credit Card’s rewards program allows you to redeem points for cashback, providing you with added financial flexibility.

Is there a grace period for purchases made with the Destiny Credit Card?

Yes, the fate Credit Card typically offers a grace period for purchases. However, refer to the terms and conditions or contact customer support for specific details.