First Republic Bank (NYSE: FRC) is a bank holding company that serves affluent people, corporations, and other entities through a variety of banking and wealth management products and services. The bank’s headquarters have been in San Francisco since its inception in 1985. The goal of this article is to provide readers with a thorough understanding of First Republic Bank stock so that they may make educated investing decisions.

Overview of First Republic Bank Stock

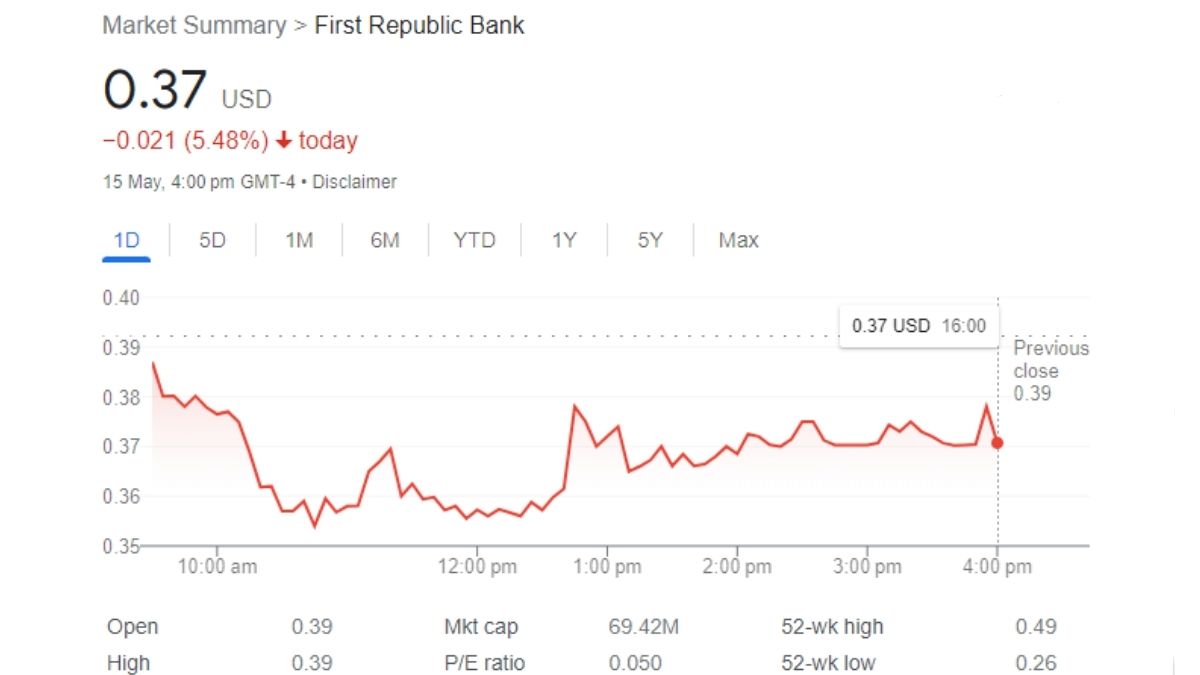

As of the 13th of May, 2023, the market capitalization of First Republic Bank is over $36.7 billion. The stock has fluctuated between $187.03 and $329.95 over the past 52 weeks, and is now trading at $287.27. First Republic Bank’s P/E ratio is 20.56 and its P/S ratio is 7.48, both of which are high when compared to similar businesses in the same industry.

Financial Performance

First Republic Bank’s financial success is indicative of its history of sustained revenue and profit expansion. A 24% rise from the previous year, the bank’s net income in 2021 was $1.7 billion. Annual sales were $4.6 billion, up 15% from the prior year. In 2021, the bank had a ROE of 14.1%, which was above the 7% average of its sector.

Growth Prospects

First Republic Bank’s business model, which centers on catering to the banking needs of ultra-wealthy people and corporations, positions it well for rapid expansion. The bank has had success in the past with its strategy of increasing its business through acquisitions and organic expansion, and that success is anticipated to continue. The bank has a solid foundation in key U.S. cities including New York, San Francisco, and Los Angeles, giving it ample room to expand.

Risks and Challenges

First Republic Bank shares carries risks and difficulties just like any other investment. The real estate market is especially susceptible to economic downturns, making the bank’s exposure to it a considerable risk. The bank’s purchase strategy may not always pay off, and it may cause operational inefficiencies and integration problems. There is a lot of rivalry for the bank from other financial firms.

Financial Ratios

Consider various key financial ratios that might shed light on First Republic Bank’s financial health and performance while examining the stock. Investors should pay special attention to the following ratios:

- Return on Equity (ROE): The Return on Equity for First Republic Bank is 14.1%, which is greater than the 12.1% average in the banking sector. Return on equity (ROE) indicates how much money a business makes for every dollar invested by its shareholders. In general, investors prefer to see a high return on equity (ROE) since it suggests that the company is making good use of the money it has been given by its shareholders.

- Price-to-Earnings (P/E) Ratio: The P/E of First Republic Bank is 20.56, which is higher than the average of its competitors. The price-to-earnings ratio (P/E ratio) measures how much buyers are ready to pay for each dollar of a company’s earnings. If the P/E ratio is high, then could mean that investors are optimistic about the company’s prospects.

- Price-to-Sales (P/S) Ratio: The P/S ratio for First Republic Bank is 7.48, which is above the industry average. An indicator of how much investors are ready to pay each dollar of a company’s revenue is the price-to-sales ratio (P/S). If the P/S ratio for a company is high, it could mean that investors see strong prospects for future revenue growth.

Dividends

The annual dividend yield for First Republic Bank stock is 0.87% thanks to a quarterly dividend payment of $0.25 per share. Despite the low dividend yield, First Republic Bank has a track record of raising its dividend payments to shareholders. The bank’s dividend payments have climbed annually since 2012, which is good news for those who invest for income.

Management and Leadership

The leadership and board of directors at First Republic Bank have decades of combined experience in banking and finance. James H. Herbert II, the current chairman and chief executive officer, has been with the company since its creation in 1985 and has been instrumental in the development and success of the bank. The company’s board of directors is comprised of various well-respected members of the business and financial communities, who collectively bring extensive experience and insight to the table.

Conclusion

Established in 1996, First Republic Bank caters to the banking needs of individuals and enterprises with significant capital. Investors are likely to view the bank favorably due to its excellent financial record, promising future growth, and reliable business model. However, buyers of the stock need to be cognizant of the difficulties and threats it poses. If you’re wanting to diversify your portfolio into the banking and financial services industries, First Republic Bank stock should be on your short list.

First Republic Bank has been around for quite some time, and it has consistently increased its profits and customer base. The company’s good business model, growth potential, and strong financial performance make it a desirable investment. However, buyers of the stock need to be cognizant of the difficulties and threats it poses. Stock in First Republic Bank should be considered by anyone with a long-term investment perspective interested in the banking and financial services industry.