HBRM Inc. (HBRM) is an OTC-traded healthcare services provider. This article examines HBRM’s recent financial performance and predicts the stock price in 2023.

Economic Forecasting

Over the past five years, HBRM’s income has increased annually, and is projected to increase by 11.1% in 2020. The gross profit margin for the company has also been on the rise, and is projected to hit 24.7% in 2020, up from 20.4% in 2019. The net income of HBRM, hbrm stock,however, has been negative for the past three years. This means that the company has been losing money. HBRM also has a high debt-to-equity ratio of 1.29, indicating that it has taken on a great deal of debt.

Recent Efforts

The leadership of HBRM has been making strides to strengthen the company’s finances and reduce debt. HBRM’s debt reduction plan from 2021 calls for the issuing of common stock to be used to pay off existing debt. Medical billing and coding are only two of the many areas in which HBRM has been actively developing, most recently with the announcement of a partnership with a major healthcare provider.

Possibilities for Financial Gain

The current activities and service expansion of HBRM may present future expansion possibilities. With the healthcare market projected to grow, HBRM can diversify its offerings and attract more customers. HBRM’s billing operations may also benefit from the company’s technological investments.

Risks

Potential HBRM stock buyers should be aware of the dangers inherent in any investment in a small-cap company trading on the OTC markets. These shares tend to be more volatile and less liquid than those found on larger exchanges. The healthcare industry is highly regulated, and government policy shifts could have an effect on HBRM’s operations and financial results.

Analyst Opinions

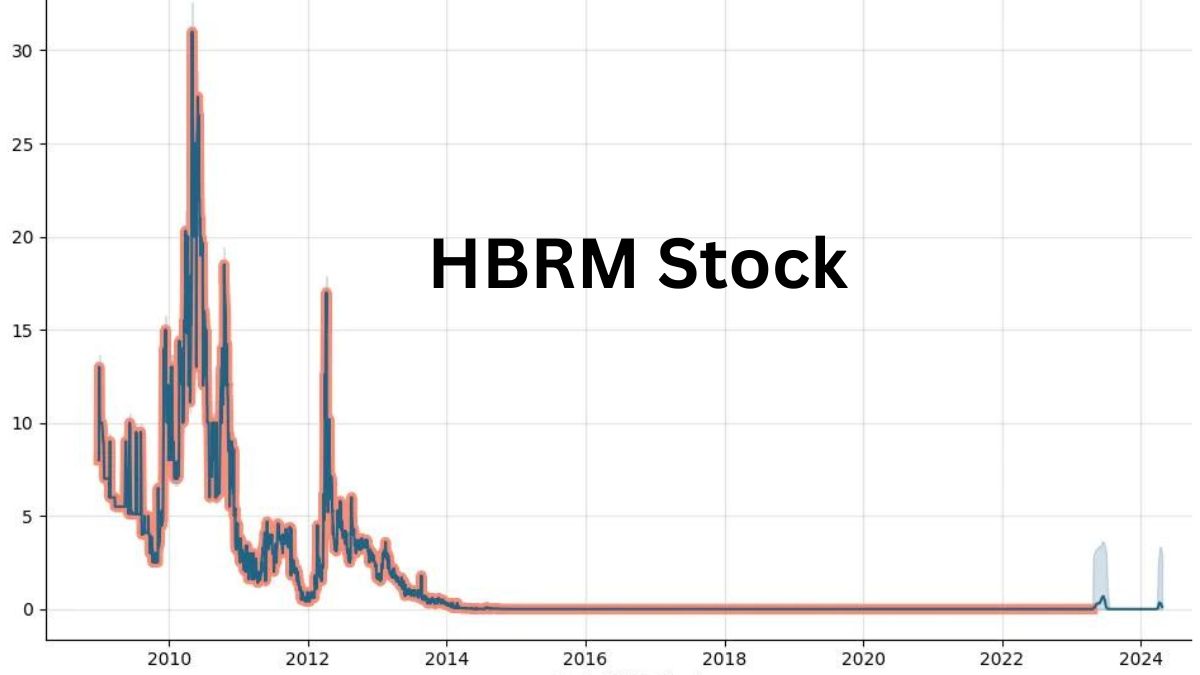

Analysts’ opinions on HBRM stock are divided. The company’s financial difficulties have led some to forecast that the stock will remain volatile, while others see the company’s recent moves as good news for the market. The stock price of HBRM has been trending upward in recent months, and this upward trend may continue through 2023.

Let’s examine the company’s strategy for paying down its debt so that we can evaluate the pros and cons of buying HBRM stock.

In order to pay off existing debt, HBRM plans to issue shares of common stock to investors. Although this might help the corporation pay off its debts, it might also lower the value of its current shares.

Furthermore, investors should be aware that HBRM’s debt-to-equity ratio of 1.29 is significantly higher than the average of 0.66 for companies in this sector. This suggests that, relative to its competitors, HBRM relies more significantly on debt financing, which carries with it the potential for increased financial risk.

A major healthcare provider has partnered with HBRM to provide medical billing and coding services, which could significantly increase HBRM’s income. hbrm stock,with the healthcare sector projected to increase in the next years, HBRM’s new offerings may help the company gain a greater market share.

In addition, HBRM’s investments in technology may promote efficiency and accuracy in its billing operations, which in turn may assist cut expenses and improve the company’s financial performance.

Not many analysts provide opinions on HBRM, which is something to keep in mind. This could be because of the company’s very low profile and OTC listing. Others remain wary owing to the company’s financial troubles and debt load, although other analysts consider recent moves as good indicators for the stock’s future.

Investing in HBRM stock has a high degree of risk, but the company’s new initiatives and service expansion may pave the way for future success. Before making any investing selections, traders should weigh the costs and benefits thoroughly.

Reduce Your Debt Strategy

In order to pay off existing debt, HBRM plans to issue shares of common stock to investors. Although this might help the corporation pay off its debts, it might also lower the value of its current shares. Before buying HBRM stock, investors should think long and hard about how the debt reduction plan might affect their portfolios.

HBRM’s agreement with a major healthcare provider to provide medical billing and coding services has the potential to significantly increase the company’s income. With the healthcare sector projected to increase in the next years, HBRM’s new offerings may help the company gain a greater market share. Investors should be aware that partnerships are not without their dangers, such as the possibility of a change in partnership conditions or the absence of a crucial partner.

Putting Money Into Technology

The money HBRM spends on technology has the potential to make its billing processes more efficient and accurate, which in turn might help the company save money and do better financially. Potential technological breakdowns and the necessity for constant updates and maintenance are two dangers that investors should be aware of before making any technological investments.

The debt reduction strategy and new alliance are just the beginning for HBRM, which has also been making significant investments in technology to enhance its offerings. According to the HBRM website, the company uses AI and ML algorithms to improve the effectiveness and precision of its billing procedures.

The healthcare market is projected to develop in the next years, giving HBRM a chance to broaden its offerings and boost its earnings. Because of the huge volume of patients and insurance claims, the COVID-19 epidemic has also brought attention to the value of medical billing and coding services.

Nonetheless, it’s worth noting that HBRM’s operations and financial performance could be affected by the heavy regulation and policy shifts plaguing the healthcare business.

Investors in HBRM stock should be aware of the dangers inherent in buying shares of any tiny, OTC-listed company. These shares tend to be more volatile and less liquid than those found on larger exchanges.

Although HBRM’s debt and financial woes are cause for concern, the company’s new efforts and development in service offerings suggest that the company may have growth potential in the future. Before making a decision, hbrm stock,investors should weigh the benefits and costs of holding HBRM stock.

the company’s debt reduction plan, cooperation with a renowned healthcare provider, and investment in technology, as well as the risks and benefits of purchasing HBRM shares. Investors should be mindful of the dangers involved with investing in small-cap companies listed on the OTC marketplaces, even though the healthcare industry is likely to continue growing.

In a nutshell, HBRM is a healthcare services provider that has been working hard to pay down debt and increase the scope of the care it offers. The company has had financial problems in the past, but its new initiatives may help it expand in the future. However, before making any investment decisions, potential buyers of HBRM stock should thoroughly weigh the risks and rewards. HBRM’s debt reduction plan and collaborations carry their own risks, as the healthcare industry is heavily regulated and prone to changes in government laws. However, hbrm stock,if HBRM is able to carry out its strategies, the company might be a good bet for investors in 2023 and beyond.