The stock of well-known cybersecurity business IronNet (IRNT) fell by 64% after it unexpectedly filed for Chapter 11 bankruptcy protection. After laying off every employee in September, the company is currently going through an asset sale-based liquidation procedure. The causes of IronNet’s bankruptcy, the ramifications for IRNT stock, and the overall background of its demise are all examined in this piece.

The Bankruptcy Filing and Asset Sale

IronNet decided to file for Chapter 11 bankruptcy due to a number of obstacles that prevented the business from avoiding taking such an extreme step. After raising money from investors, the company changed its mind and decided to file under Chapter 11. As the company is being liquidated, the bankruptcy is being used as a springboard for an asset sale.

According to court filings, the Chief Financial Officer provided a crucial explanation for the company’s bankruptcy: it ran out of money. Due in part to this financial burden, IronNet was unable to fulfill its obligations, which forced it to make the difficult decision to declare bankruptcy.

Previous Troubles and Delisting

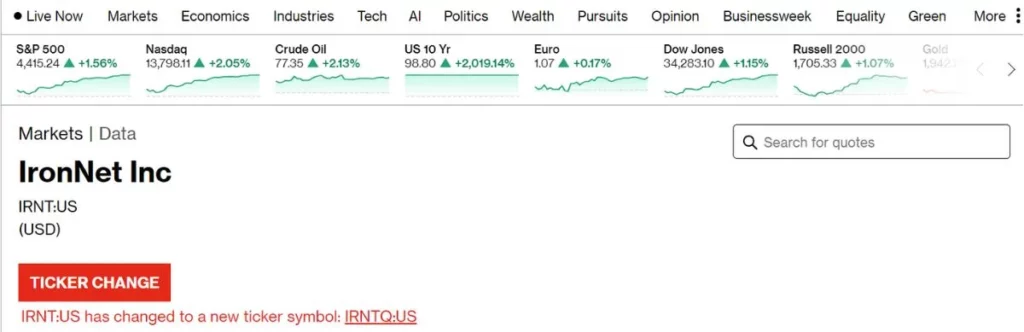

IronNet’s financial difficulties were not a singular occurrence. In September of last year, the company fired every employee in an effort to pay off a significant debt of $35 million to creditors. The voluntary delisting of IronNet’s shares from the New York Stock Exchange (NYSE) in July, which led to a switch to over-the-counter trading, was another noteworthy development.

IRNT Stock’s Immediate Response

It should come as no surprise that IRNT stock is suffering following the bankruptcy filing; as of Monday morning, shares had dropped 63.6%. Given the anticipated asset sale during the Chapter 11 process, investors’ skepticism regarding the company’s future makes sense. Given the ongoing liquidation procedures and the significant decline in IRNT’s stock value, it is evident that there is a lack of faith in the company’s potential to recover.

The Aftermath of Employee Layoffs

IronNet’s decision to fire every employee in September is a sign of the company’s frantic attempts to pay its debts. This action not only had a detrimental effect on the employees but also gave investors the impression that the business was in serious trouble. The subsequent filing for bankruptcy highlights how dire IronNet’s financial situation is, putting both stockholders and staff in danger.

Shift from NYSE to Over-the-Counter Trading

The voluntary delisting of IronNet from the NYSE and the subsequent move to OTC trading are more indicators of the company’s difficulties. This is typically an indicator of a company’s financial difficulty or an attempt to sidestep the strict NYSE compliance regulations. The change may have eroded investor confidence, which in turn lowered the price of IRNT shares.

Analysts’ Perspectives on IRNT Stock

Given the circumstances surrounding the bankruptcy filing, analysts are skeptical about IRNT stock’s chances for recovery. With no other options available, IronNet has decided to sell its assets, and its stock price has dropped significantly as a result, suggesting investors are pessimistic about the company’s future. IronNet’s reemergence from bankruptcy might be complicated by the intense competition inherent in the cybersecurity market.

Broader Market Impact

IronNet’s demise is only the latest example of a company experiencing financial difficulties; even cybersecurity companies aren’t immune to the perils of a dynamic sector. The occurrence encourages investors to reconsider their investments in comparable businesses and raises worries about the general viability of the cybersecurity sector. There may be a domino effect on the market that affects the value of technology and cybersecurity stocks.

Conclusion

The filing of Chapter 11 bankruptcy by IronNet, previously a leading cybersecurity firm, is a major setback. The filing decision, in addition to other problems including layoffs and delisting, is bad news for IRNT shares. The bankruptcy procedure and the expected sale of IronNet’s assets have left investors reeling from a significant decline in stock value. This episode serves as a cautionary story for investors navigating the complexity of a quickly changing market as the cybersecurity business continues to expand.

ALSO READ: Unlocking the Potential: Analyzing YouTube’s Stock Performance and Future Growth Prospects