MFS Multimarket Income Trust has a preferred stock symbol of MMTLP. It’s a novel choice for those seeking a less risky but steadier source of income. In this article, we’ll take a close look at MMTLP stock and assess its price movement and investment possibilities.

Preferred stocks are a special type of stock that pays a predetermined dividend to its investors every year. Due to its consistent dividend payments, MFS Multimarket Income Trust Preferred Stock (MMTLP) has been a popular investment option. In this piece, we’ll take a close look at MMTLP stock and assess its investing merits.

Overview of MMTLP Stock

MFS Multimarket Income Trust (MMTLP) is a preferred stock. Its par value is $25 and it distributes dividends once every three months. MMTLP is a stock that trades under the symbol “MMTLP” on the New York Stock Exchange. In the event of a liquidation or dividend payment, MMTLP preferred stock would be paid out before common stock.

Analysis of MMTLP Stock

Looking at MMTLP’s financial results and market tendencies will help us evaluate the stock’s potential as an investment. Strong financial performance and dividend stability over multiple years are two hallmarks of MFS Multimarket Income Trust. The dividend yield on MMTLP is now about 5.5%, which is higher than the dividend yield on the typical stock in the S&P 500. The NAV per share, which is directly proportional to the value of the company’s assets, has remained stable throughout time.

Price Trends of MMTLP Stock

Over the course of the last few years, the value of MMTLP shares has been quite consistent. However, due to shifts in interest rates and market conditions, there have been some price variations. Since MMTLP is a preferred stock, it is less risky than regular equities and consistently pays dividends to its investors. The following is a chart showing the historical price movement of MMTLP stock.

Investment Potential of MMTLP Stock

If you’re seeking for a low-risk investment that will generate a constant income, MMTLP could be a good fit. It’s a great option for those who don’t want to deal with the ups and downs of the stock market. The price of MMTLPstock, however, can be negatively impacted by an increase in interest rates because preferred stocks are sensitive to fluctuations in interest rates.

MMTLP vs. Common Stocks

There are a number of ways in which MMTLP stands out from common stocks. Preferred stocks offer a fixed dividend payout and priority in receiving dividends, whereas ordinary stocks offer ownership in a corporation and the possibility of financial appreciation. Preferred stocks provide investors with a steady stream of income and are less risky than regular equities. The profits and growth prospects of ordinary stocks, however, are more substantial.

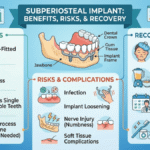

Risks of Investing in MMTLP Stock

Despite the security of MMTLP’s dividends, preferred stock investments carry with them the usual dangers. The stock’s vulnerability to interest rate fluctuations is a major concern for MMTLP investors. Investors in MMTLP face the risk of a loss if interest rates rise and the stock price falls. Investors may not recoup their entire investment if a MMTLP goes bankrupt, and the stock is not FDIC-insured.

How to Invest in MMTLP Stock

MMTLP stock is available for purchase by investors through traditional brokerage accounts and electronic trading platforms. Do your homework on MMTLP’s financial record and industry tendencies before buying the stock. Before buying MMTLPstock, investors should evaluate their investment objectives, risk tolerance, and time horizon.

Investment Strategies for MMTLP Stock

When purchasing shares of MMTLP, investors can use a variety of tactics. MMTLP could be a part of a diverse portfolio of income investments. As a result, the portfolio’s risk and return can be more evenly distributed, and a reliable income stream can be secured. Trading MMTLP stock depending on market conditions and price movements is another option. This tactic, however, is best suited for investors with experience and a deep familiarity with the market.

Tax Implications of Investing in MMTLP Stock

Investors should also think about how buying MMTLP shares would affect their tax situation. Qualified dividends, which include those paid out by MMTLP, are taxed at a lower rate than ordinary dividends. Qualified dividends are subject to taxation, although the rate is determined by the investor’s income tax bracket. Investors should talk to a tax expert about how buying MMTLPstock will affect their personal tax situation.

Comparison with Other Preferred Stocks

MMTLP could be compared to other preferred stocks on the market by investors. Preferred shares of Bank of America, General Electric, and AT&T are a few additional examples of well-known stocks in this category. Before committing capital, investors should weigh several preferred stocks in terms of return on investment (ROI), dividend yield, and market momentum.

Ratings and Reviews of MMTLP Stock

Before buying MMTLPstock, prospective buyers can also read ratings and reviews. Yahoo Finance, Morningstar, and MarketWatch are just a few of the financial websites that rate and assess MMTLPstock based on factors including performance, risk, and price. Before making any investment decisions, investors should read the reviews thoroughly and think about the reliability of the source.

Diversification of Investment Portfolio

Stocks, bonds, and alternative investments are just few of the asset classes that can be included in a diversified portfolio. This can lessen the weight that any one investment has on the whole portfolio’s risk and return. Investment diversification can help investors meet their financial goals and protect them from the market’s ups and downs.

Market Conditions and Outlook for MMTLP Stock

Before buying MMTLP stock, investors should think about the market and the company’s future. The value of MMTLPstock is susceptible to external factors including interest rates, GDP growth, and corporate performance. In order to keep up with market trends and make educated investing decisions, investors should keep an eye on these indicators and analyze MMTLPstock on a regular basis.

Risks Associated with Investing in MMTLP Stock

Investors also need to be aware of the dangers of buying MMTLP shares. Market volatility, credit risk, liquidity risk, and interest rate sensitivity are all potential negative outcomes. Before deciding to purchase MMTLPstock, investors should do their homework and become familiar with these dangers. Before putting money into any security, investors should carefully examine their risk tolerance and diversify their holdings.

Long-Term Investment Potential of MMTLP Stock

The long-term potential of MMTLP stock is another factor investors should think about. Historically, MFS Multimarket Income Trust has maintained its dividend payout and done well in the market. MMTLPstock could be a good choice for investors seeking a reliable stream of income over the long run.

Investment Horizon and Goals

Before buying MMTLP stock, investors should think about their time horizon and financial objectives. Due to its long-term income generating focus, MMTLPstock may not be a good choice for those hoping for a quick return on investment. It is important for investors to think about why they are investing, whether it is for capital growth or income.

Institutional Ownership and Trading Volume of MMTLP Stock

Before purchasing MMTLP shares, potential buyers should think about the stock’s institutional ownership and trading volume. Hedge funds and pension funds are two types of institutional investors that can have a major impact on a stock’s price and trading volume. Significant institutional ownership and trading activity may be indicative of bullish sentiment toward a stock and a promising future for the underlying firm.

Valuation of MMTLP Stock

Before buying MMTLPstock, investors need to think about how much the company is worth. Price-earnings ratio, price-book ratio, and dividend yield are all examples of popular valuation indicators. If an investor wants to know if MMTLPstock is overvalued or undervalued, they should look at how it is valued in relation to other favored stocks. The valuation of a firm can be informed by research into its past and future financial results and prospects.

Company Management and Governance

The management and governance of MMTLP are additional factors that investors should think about. The financial results and stock price of a firm can be affected by the track record and experience of its management team. To guarantee the company is acting in the best interests of its shareholders, investors should also investigate the board’s makeup and executive remuneration practices.

Industry and Market Trends

The performance of MMTLPstock can be affected by general market and industry developments, which investors should take into account. MFS Multimarket Income Trust operates in the financial industry, which is vulnerable to fluctuations in interest rates, the economy, and government regulation. In order to keep up with market trends and make educated investment decisions, investors should keep tabs on these movements and analyze MMTLPstock on a regular basis.

Conclusion

Mmtlp stock is a preferred stock that provides investors with a reliable stream of income and less risk than the main stock market. Before buying MMTLPstock, investors should think about the company’s valuation, management and governance, industry and market trends, and the volume of trading activity among institutional investors. Successful investors know the importance of doing their homework and keeping up with market developments in order to make educated investment selections and realize their financial objectives.