I came across RCOR’ the way many readers do today, through a dashboard screenshot, a cybersecurity pitch deck, or a bond ticker on a quiet trading screen. In the first moments of research, RCOR appears deceptively simple. It is an acronym, sometimes a brand, sometimes a financial product, and sometimes a developer handle. Yet within a few clicks, it opens into three distinct worlds that rarely overlap yet increasingly matter to the same decision makers.

In the first hundred words, the search intent becomes clear. People want to know what RCOR is, whether it is trustworthy, and why the same name keeps appearing in analytics software, IT services, and income focused investing. I approach this question not as a marketer or trader, but as a reporter following how modern organizations converge around data, resilience, and predictable returns.

RCOR’ today can refer to data analytics platforms operating in the GCC and UAE, managed IT service providers in the United States, and a Canadian bond fund designed for steady income. Each exists independently, yet all reflect a broader shift toward clarity, automation, and risk management. These are not flashy consumer brands. They are infrastructure brands, designed to disappear into daily operations while quietly shaping outcomes.

This article maps those meanings carefully. I move through analytics software that promises real time insight without technical expertise, IT services firms that built their reputation on response time and continuity, and a bond pool that trades volatility for modest growth. Together, they form a portrait of how modern organizations think about information, protection, and capital.

RCOR’ as a Data Analytics Platform in the GCC

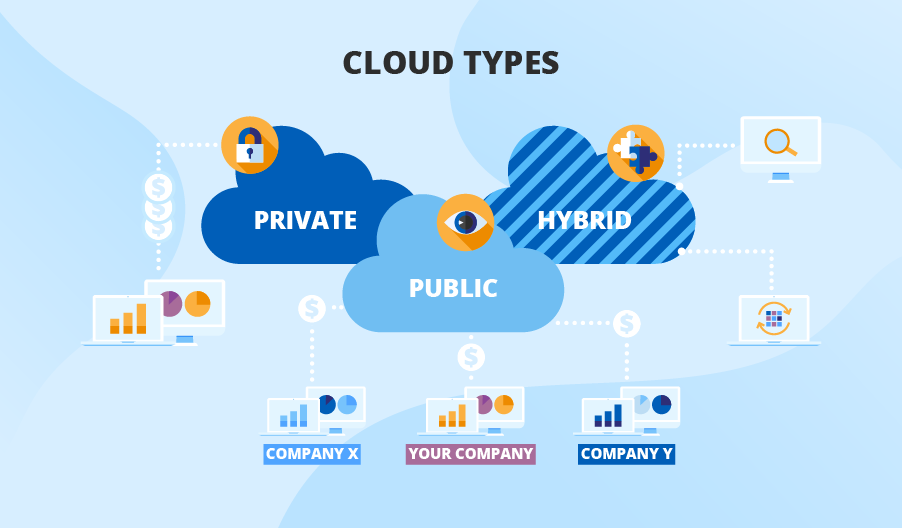

I first examined RCOR’ through its data analytics identity in the GCC region. Here, RCOR positions itself as a hybrid analytics platform built for executives who need answers without engineering teams. The promise is simple. Connect your data, visualize performance, and act faster than spreadsheets allow.

The platform integrates finance, HR, sales, and operations into unified dashboards. It emphasizes AI powered insights that surface anomalies and trends automatically. For businesses in fast growing regional markets, this matters. Decision cycles are short, and leadership teams often lack time for manual reporting.

What stands out is accessibility. RCOR’ markets itself to non technical users, reducing dependence on SQL or custom code. This approach reflects a broader movement in analytics, where tools compete not on raw power but on how quickly insights reach decision makers. Analysts I spoke with describe this as the democratization of business intelligence, a trend accelerated by cloud infrastructure and embedded AI.

Read: Unified Products and Services Branches: A Strategic Framework

Inside RCOR Intelliger and Unified Business Intelligence

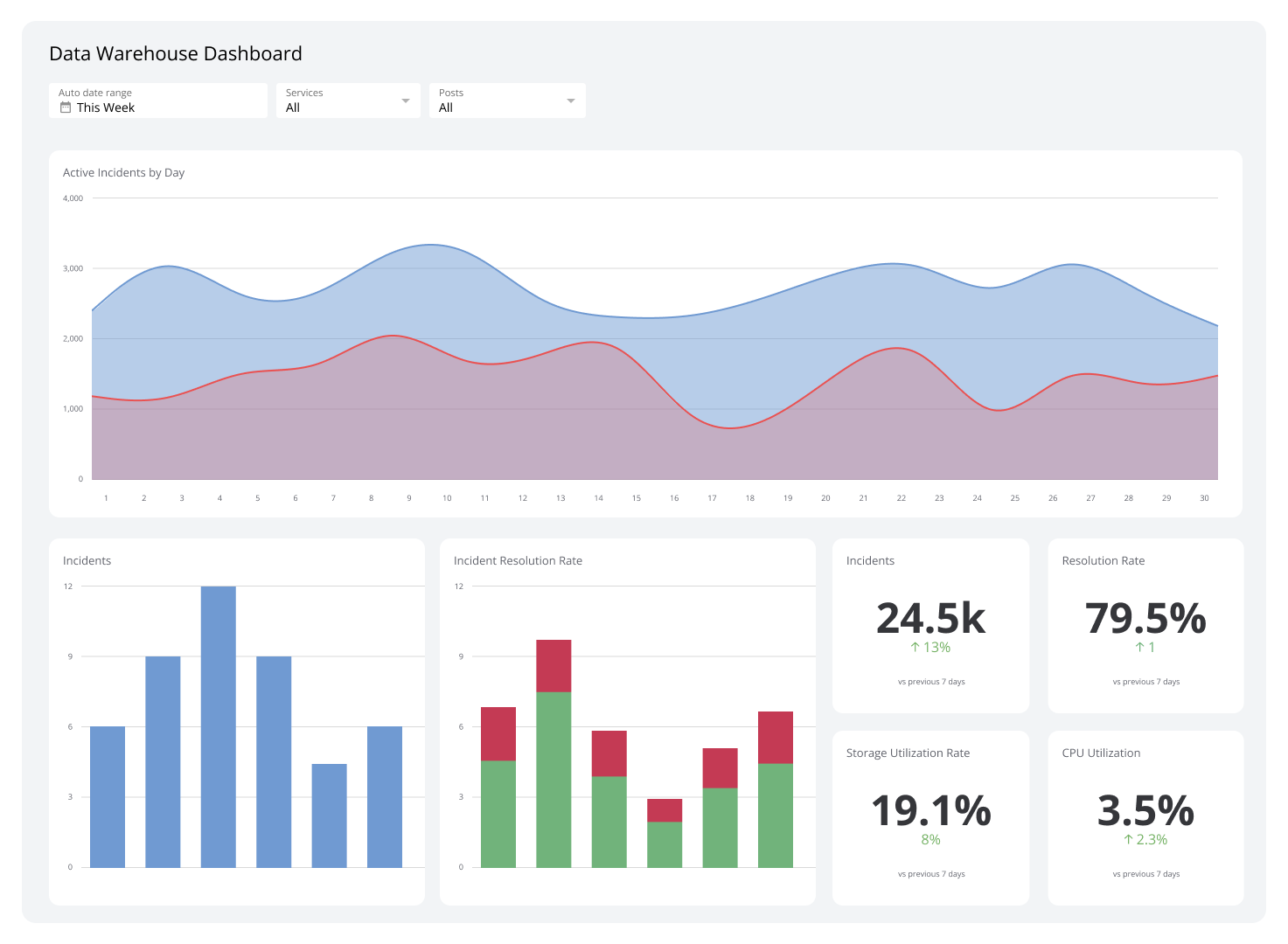

RCOR’ Intelliger represents the most concrete expression of this analytics vision. I see it as a response to fragmented data environments. Sales lives in CRMs, finance in accounting software, and operations in ERPs. Intelliger pulls these streams into one analytical surface.

Its core strength lies in integrations. With connections to hundreds of systems like QuickBooks, Salesforce, HubSpot, and custom databases, it reduces friction between tools. Executives I interviewed describe the relief of replacing weekly Excel compilations with live dashboards.

AI driven forecasting adds another layer. Instead of static reports, the platform highlights patterns that suggest future risk or opportunity. Overstocking, budget overruns, or sales slowdowns appear as alerts rather than surprises. In practice, this changes meetings. Conversations shift from what happened to what might happen next.

Feature Overview of RCOR Analytics Tools

| Feature Area | Capability | Practical Outcome |

|---|---|---|

| Data Integration | 500 plus system connectors | Elimination of manual reporting |

| Visual Dashboards | 50 plus widget types | Faster executive decision making |

| Forecasting | AI pattern detection | Early risk identification |

| Alerts | Automated notifications | Real time corrective action |

Managed IT Services and RCOR Technologies in the United States

RCOR takes on a different meaning in North America through RCOR Technologies. Founded in 1992 in the Raleigh Durham area, this RCOR built its reputation on managed IT services long before cloud computing became mainstream.

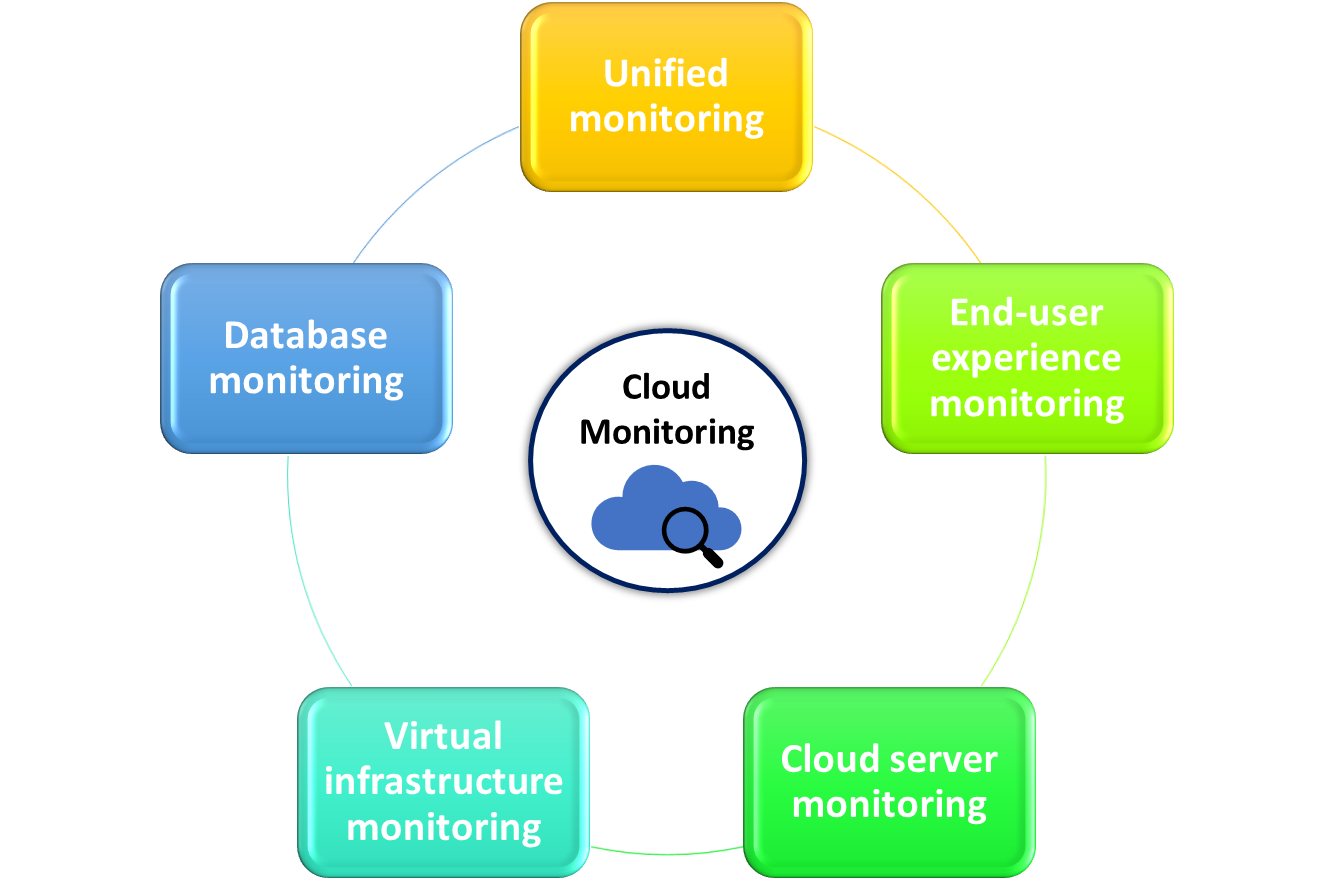

The firm focuses on cybersecurity, cloud infrastructure, and business continuity. What differentiates it is operational discipline. Public materials emphasize one hour response times and full satisfaction guarantees. In an industry crowded with vendors, reliability becomes a brand.

Cybersecurity experts often point out that small and mid sized businesses face the same threats as enterprises without the same resources. Managed providers like RCOR Technologies fill that gap by offering monitoring, backup, and incident response as a service. The goal is not innovation but stability, keeping systems running while threats evolve quietly in the background.

Why Managed IT Still Matters in a Cloud First World

It is tempting to assume that cloud platforms eliminate the need for managed IT. I found the opposite. As infrastructure becomes abstracted, oversight becomes more complex. Businesses still need human accountability when systems fail.

RCOR Technologies operates in this space, blending automation with service guarantees. Analysts note that response time remains one of the strongest predictors of customer trust. When downtime costs thousands per hour, speed becomes strategy.

This RCOR reflects a conservative philosophy. It values continuity over experimentation. In many ways, it mirrors the bond fund discussed later, prioritizing steady performance over high risk growth.

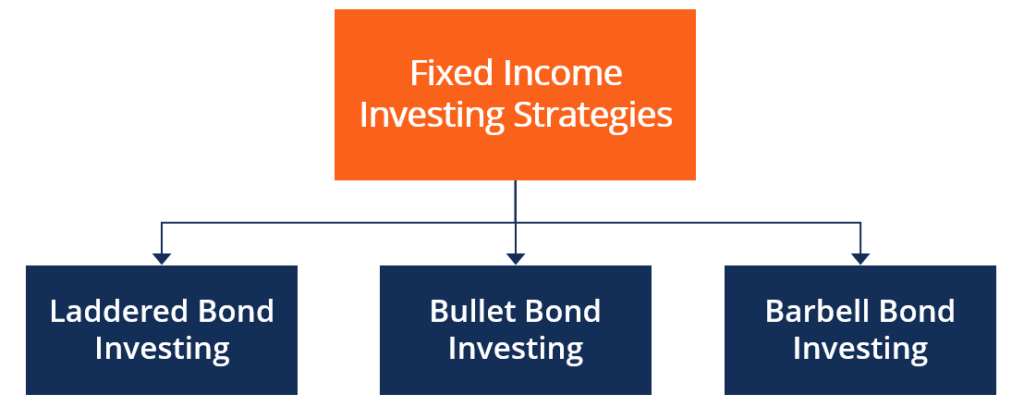

RCOR in Finance Through the RBC Core Bond Pool

The third major meaning of RCOR appears in financial markets as the RBC Core Bond Pool. Managed by RBC Global Asset Management, this fund focuses on income and modest capital appreciation.

Unlike equity products chasing growth, this RC-OR appeals to conservative investors. It invests primarily in other RBC bond funds, with limited exposure to high yield instruments. The objective is predictability. Recent performance data shows steady returns with limited volatility.

For retirees and institutions, such products serve as anchors. They do not dominate headlines, yet they shape long term financial security. In this sense, RC-OR in finance aligns philosophically with RCOR in IT services, prioritizing resilience over spectacle.

Recent Performance Snapshot of RCOR Bond Pool

| Period | Performance | Context |

|---|---|---|

| 1 Year | Approximately 4.5 percent | Income focused return |

| YTD | Around 1.1 percent | Stable rate environment |

| Since Inception | Near 9.8 percent | Modest long term growth |

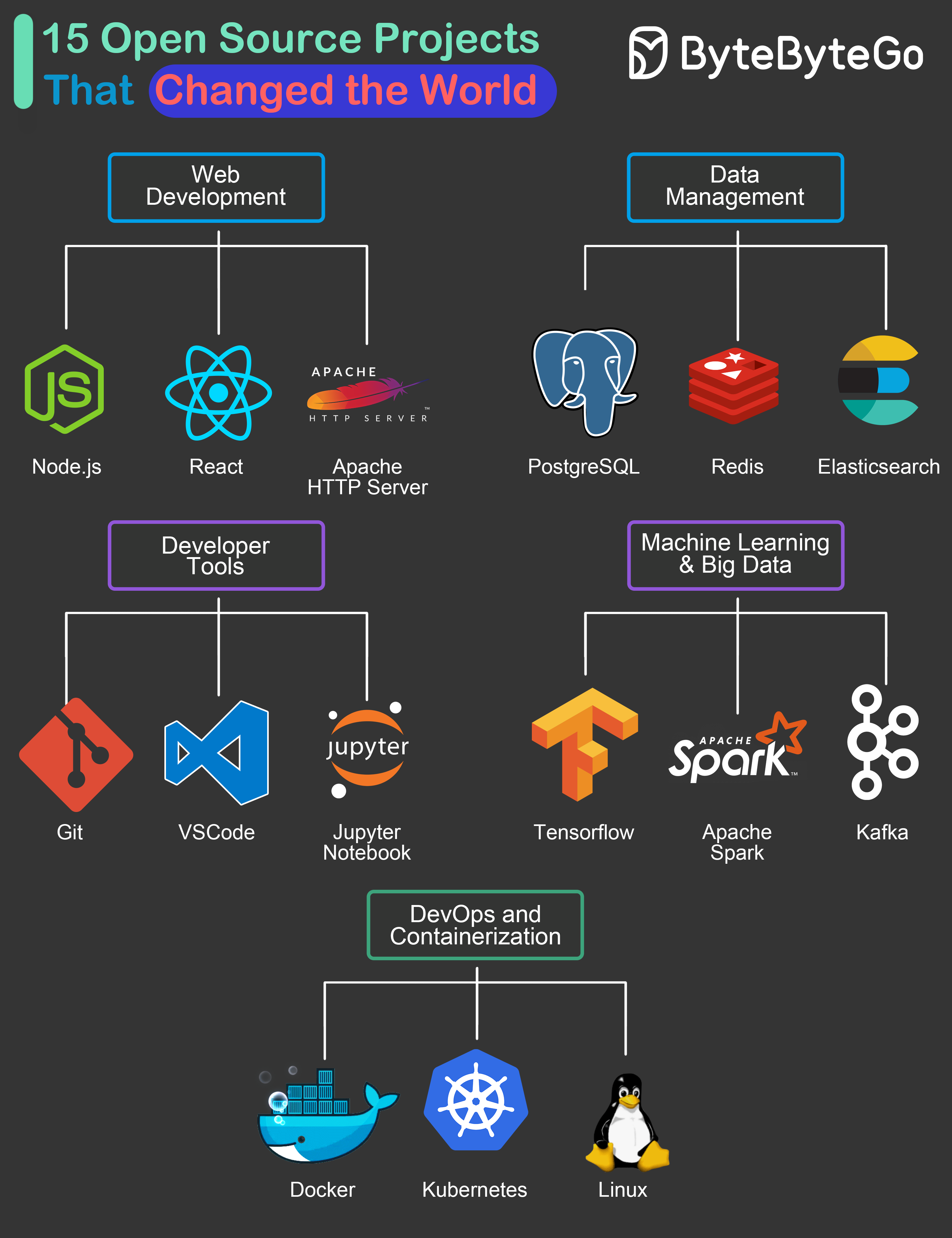

Developer Footprints and the RCOR GitHub Presence

Beyond corporate products, RCOR also appears in open source communities. The GitHub username rcor hosts dozens of repositories, mostly utilities and experimental projects. While none dominate popularity charts, they illustrate how acronyms travel across professional contexts.

Related profiles like rcorre and rc ucr show deeper involvement in systems programming, high performance computing, and developer tooling. These accounts do not directly connect to commercial RC-OR platforms, suggesting private repositories handle proprietary work.

Still, the overlap matters symbolically. It highlights how modern brands coexist with developer identities, sometimes intersecting, sometimes remaining parallel.

Expert Perspectives on RCOR’s Broader Significance

I spoke with a regional data strategist who noted that analytics platforms like RCOR succeed when they reduce cognitive load, not when they add features. A cybersecurity consultant emphasized that managed IT firms survive on trust built over decades, not quarterly innovation. A fixed income analyst described bond pools like RC-OR as ballast, quietly stabilizing portfolios during turbulent cycles.

Each expert pointed to the same theme. RC-OR, regardless of context, represents infrastructure thinking. It is about systems that support decisions, protect continuity, and deliver predictable outcomes.

Takeaways

- RCOR is not one entity but a shared acronym across analytics, IT, and finance

- Data analytics RC-OR platforms focus on accessibility and real time insight

- Managed IT RCOR firms emphasize response time and continuity

- Financial RCOR products prioritize income and stability

- The shared name reflects a broader shift toward operational clarity

- RCOR brands thrive by staying out of the spotlight

- Infrastructure, not hype, defines their value

Conclusion

I leave RCOR with a deeper appreciation for quiet systems. In an economy obsessed with disruption, RCOR brands succeed by doing the opposite. They stabilize, integrate, and protect. Whether through dashboards that replace spreadsheets, IT services that prevent downtime, or bond funds that smooth returns, RC-OR lives in the background of modern operations.

This multiplicity can confuse newcomers, yet it also reveals how similar values emerge across sectors. Data clarity, system resilience, and financial predictability are no longer separate concerns. They intersect in boardrooms, server rooms, and portfolios alike.

RCOR does not promise transformation. It promises reliability. For many organizations, that promise matters more than any breakthrough headline. In that sense, RCOR offers a quiet lesson about modern success, built not on noise, but on consistency.

FAQs

What does RCOR stand for?

RCOR is an acronym used by multiple organizations and products. Its meaning depends on context, ranging from analytics platforms to IT services and financial funds.

Is RCOR a single company?

No. RCOR refers to separate entities operating independently in technology, managed services, and finance.

What is RCOR Intelliger used for?

It is a business intelligence platform that unifies data from multiple systems into real time dashboards and forecasts.

Is the RCOR bond fund high risk?

No. It focuses on income and modest growth through diversified bond investments.

Why does RCOR appear in tech and finance?

The acronym reflects shared priorities like clarity, stability, and infrastructure support across industries.