Welcome to the exciting world of mutual funds, where financial ventures flourish and fortunes are made! And at the forefront of this revolution is none other than Marc J Gabelli. If you’re curious about how one man’s vision transformed an entire industry, then hold on tight as we delve into the remarkable rise of mutual funds and explore the groundbreaking contributions that Marc J Gabelli has made along the way. So grab your notepads and get ready for a thrilling journey through finance history!

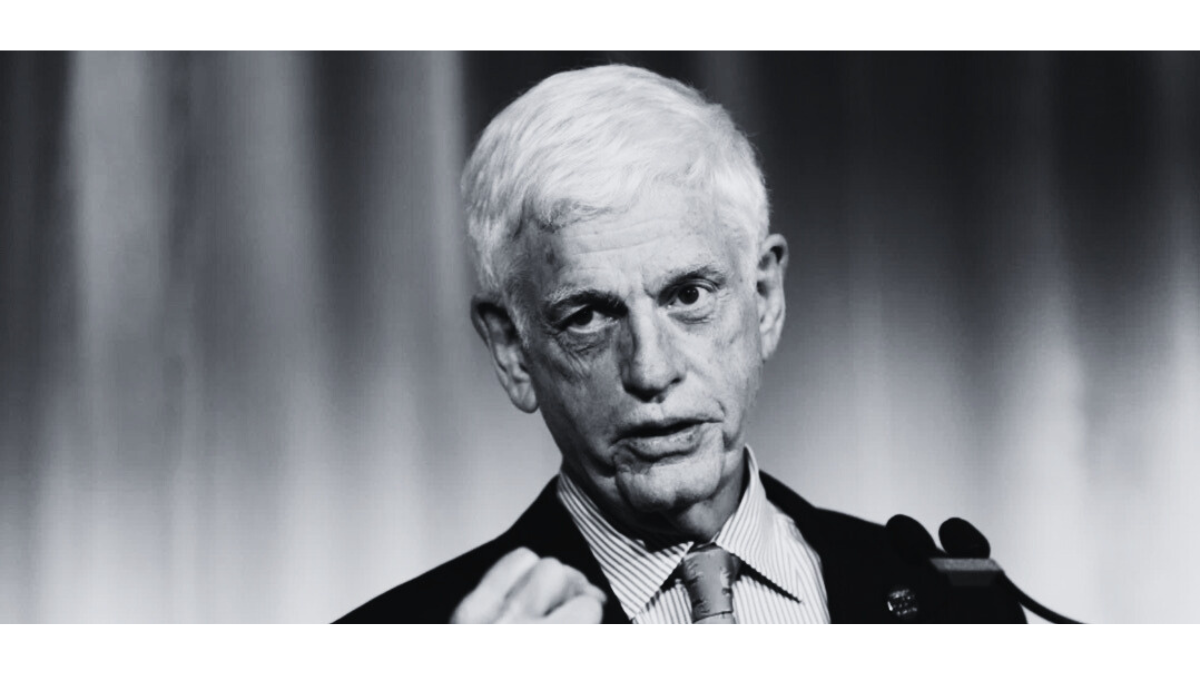

Marc J Gabelli’s Background and Biography

Born into a family deeply rooted in the financial industry, Marc J Gabelli was destined to make his mark in the world of investments. With his father as a renowned stock picker and mutual fund pioneer, Gabelli grew up surrounded by discussions on market trends and investment strategies. It was no surprise that he developed an early passion for finance.

After completing his education at Columbia Business School, Gabelli joined forces with his father’s firm, founding Gamco Investors Inc. This marked the beginning of an illustrious career that would span decades. With a keen eye for spotting undervalued assets and a knack for identifying emerging market trends, Gabelli quickly established himself as one of the leading minds in the investment community.

Gabelli’s background also includes extensive experience in portfolio management and securities analysis. His expertise covers various sectors ranging from technology to consumer goods, allowing him to navigate through diverse market conditions with ease.

Beyond his professional endeavors, Gabelli is known for being actively involved in charitable causes. He has shown dedication to giving back to society through initiatives focused on education and healthcare.

Through sheer determination and unwavering commitment to excellence, Marc J Gabelli has carved out an indelible legacy within the financial industry. Harnessing both technical prowess and deep-rooted intuition, he continues to shape markets with innovative strategies that have stood the test of time.

The Beginnings of the Mutual Fund Industry

The mutual fund industry has come a long way since its humble beginnings. It all started in the early 1920s when investment trusts were introduced as a way for individuals to pool their money together and invest in a diversified portfolio of securities. These investment trusts, also known as closed-end funds, allowed investors to gain access to a wide range of stocks and bonds without having to purchase them individually.

However, it wasn’t until the 1930s that the modern-day mutual fund was born. In response to the stock market crash of 1929 and subsequent Great Depression, new regulations were put in place by the U.S. government to protect investors. One such regulation was the Investment Company Act of 1940, which defined what constitutes a mutual fund and established rules regarding their operation.

During this time, Marc J Gabelli’s father Mario Gabelli recognized the potential of mutual funds as an effective investment vehicle for individual investors. He saw an opportunity to democratize investing by offering professionally managed portfolios accessible to all. This vision laid the foundation for what would become one of Marc J Gabelli’s greatest contributions – revolutionizing the mutual fund industry.

Marc J Gabelli took his father’s vision further by introducing innovative strategies that set his funds apart from others in the market. He emphasized active management and value investing principles, seeking out undervalued companies with strong growth potential.

Gabelli also played a key role in advancing shareholder activism within mutual funds. He believed that shareholders should have a voice in corporate governance decisions and actively engaged with companies on behalf of his clients’ interests.

These innovations not only helped differentiate Gabelli’s funds but also had a significant impact on the financial market as a whole. By popularizing active management strategies and advocating for shareholder rights, he challenged conventional wisdom and paved the way for greater transparency and accountability within corporations.

Today, Marc J Gabelli continues his influential role as Chairman & CEO at Associated Capital Inc and Gamco Investors Inc. These firms, built on the principles of his father

Gabelli’s Contribution to the Mutual Fund Industry

Marc J Gabelli, a renowned name in the financial world, has made significant contributions to the mutual fund industry. With his innovative strategies and forward-thinking approach, he revolutionized the way mutual funds operate.

- One of Gabelli’s notable contributions is his emphasis on value investing. He recognized early on that identifying undervalued stocks could lead to substantial returns for investors. This approach helped him achieve consistent growth and outperform many other funds in the market.

- In addition to value investing, Gabelli also introduced various innovations in the mutual fund industry. One such innovation was sector-focused investment vehicles. By launching specialized funds targeting specific sectors like media or telecommunications, he provided investors with more targeted options and greater diversification opportunities.

- Furthermore, Gabelli played an instrumental role in advocating for shareholder rights and corporate governance reforms. He believed in actively engaging with companies as a shareholder and promoting transparency and accountability among management teams.

- Gabelli’s contributions had a profound impact on the financial market as well. His success demonstrated that active management can deliver superior results compared to passive index-tracking strategies. This insight challenged conventional wisdom at the time and paved the way for new approaches within the industry.

- Today, Gabelli continues to make strides in his role at Associated Capital Inc and Gamco Investors Inc., where he serves as Chairman/CEO/Portfolio Manager respectively. Through these positions, he remains committed to delivering exceptional performance while upholding strong ethical standards.

Innovations and Strategies Introduced by Gabelli

Marc J Gabelli is not only a pioneer in the mutual fund industry but also an innovator who has introduced various strategies to shape the landscape of investment management. One of his notable contributions was the introduction of value investing. This strategy involves identifying undervalued stocks with strong growth potential, allowing investors to capitalize on their future appreciation.

Additionally, Gabelli revolutionized the concept of shareholder activism within mutual funds. He believed that shareholders should actively participate in corporate decisions and created a platform for them to voice their opinions. By engaging directly with companies through proxy voting and advocating for changes in governance or strategic direction, he aimed to enhance shareholder value.

Furthermore, Gabelli’s approach to research and analysis set him apart from his peers. He emphasized conducting thorough fundamental research on companies across different sectors, seeking out opportunities others may have overlooked. This allowed him to uncover hidden gems and make informed investment decisions.

Gabelli also demonstrated an aptitude for mergers and acquisitions (M&A). His expertise in this area enabled him to identify synergistic combinations between companies, maximizing returns for investors while minimizing risks associated with such transactions.

Marc J Gabelli’s innovative strategies have had a significant impact on the mutual fund industry. The introduction of value investing, emphasis on shareholder activism, meticulous research practices, and proficiency in M&A have shaped not only his own success but also influenced countless other professionals within the field.

As we delve deeper into Marc J Gabelli’s accomplishments as an influential figure in finance and investment management fields! We will explore his role at Associated Capital Inc

Impact on the Financial Market

Gabelli’s contribution to the mutual fund industry had a significant impact on the financial market. His innovations and strategies not only revolutionized the way mutual funds were managed but also influenced how investors approached their investment decisions.

One of Gabelli’s key contributions was his focus on value investing. He believed in identifying undervalued stocks and holding them for long-term growth. This approach challenged conventional wisdom and proved to be highly successful, earning him a reputation as an astute investor.

His emphasis on research and analysis also helped elevate the standards of due diligence in the industry. Gabelli encouraged thorough analysis of companies’ financials, competitive landscape, and overall market trends before making any investment decisions. This disciplined approach ensured that investors had access to reliable information and made more informed choices.

Furthermore, Gabelli’s involvement in shareholder activism brought attention to corporate governance issues within companies. By actively engaging with management teams and advocating for changes that would benefit shareholders, he played a crucial role in promoting transparency and accountability among corporations.

Gabelli’s influence extended beyond just managing mutual funds; it shaped the very foundations of how investments were approached in the financial market. His innovative strategies, commitment to value investing, rigorous research methods, and shareholder advocacy all contributed to creating a more transparent and efficient marketplace for investors worldwide.

Gabelli’s Role in Associated Capital Inc and Gamco Investors Inc

Gabelli’s role in Associated Capital Inc and Gamco Investors Inc has been instrumental in shaping the success of these companies. As the Chairman and CEO, he has brought his expertise and innovative strategies to drive growth and deliver exceptional results.

At Associated Capital Inc, Gabelli has played a vital role in overseeing its investment management business. With a focus on value investing, he has guided the company to identify undervalued assets and generate significant returns for shareholders.

Under Gabelli’s leadership, Gamco Investors Inc has become a prominent player in the asset management industry. His keen eye for opportunities and ability to adapt to market trends have allowed the company to thrive amidst changing economic conditions.

As an active portfolio manager, Gabelli’s investment approach is built on thorough research and analysis. He seeks out companies that possess strong fundamentals, attractive valuations, and potential catalysts for growth. This disciplined approach has consistently delivered superior performance for clients over the years.

Furthermore, Gabelli’s commitment to shareholder activism sets him apart from others in the industry. He actively engages with companies’ management teams to unlock shareholder value through initiatives such as corporate governance reforms or strategic divestitures.

Gabelli’s contributions at Associated Capital Inc and Gamco Investors Inc have been pivotal in driving their success. Through his visionary leadership, innovative strategies, and unwavering dedication to delivering value for shareholders, he continues revolutionizing the mutual fund industry while leaving an indelible mark on financial markets worldwide

Marc J Gabelli’s Success and Achievements

Marc J Gabelli’s success and achievements in the mutual fund industry are nothing short of remarkable. With his innovative ideas and strategic approach, he has made a lasting impact on the financial market.

One of Gabelli’s significant achievements is his role in building Associated Capital Inc and Gamco Investors Inc. These companies have become influential players in the investment management field under his leadership. He has helped them grow into successful enterprises by implementing sound investment strategies and attracting a loyal base of clients.

Gabelli’s ability to identify promising investment opportunities sets him apart from others in the industry. His keen eye for undervalued stocks and potential growth sectors has consistently resulted in impressive returns for investors. This track record of success further solidifies his reputation as a top-notch asset manager.

Marc J Gabelli stands out as a trailblazer in the mutual fund industry with an impressive list of accomplishments under his belt. His dedication to excellence, innovative thinking, and philanthropic efforts make him a true inspiration for aspiring professionals in finance.

The Future of Mutual Funds and Gabelli’s Influence

The future of mutual funds looks promising, and Marc J Gabelli has played a significant role in shaping this industry. With his innovative ideas and strategies, he has revolutionized the way mutual funds operate and continue to thrive.

One of the key areas where Gabelli’s influence can be seen is in the use of technology. He recognized early on that leveraging technology could greatly enhance the efficiency and effectiveness of mutual fund management. By adopting advanced analytics tools and automated systems, fund managers can make more informed investment decisions, resulting in better returns for investors.

Another aspect where Gabelli has made an impact is in expanding the range of investment options available within mutual funds. He introduced new types of funds that focus on specific sectors or themes, allowing investors to diversify their portfolios even further. This approach not only attracts more investors but also provides them with tailored opportunities aligned with their investment goals.

Gabelli’s emphasis on active management has also set him apart from traditional passive index-tracking approaches commonly associated with mutual funds. Through active management, he believes that skilled portfolio managers can consistently outperform market benchmarks by identifying undervalued securities and capitalizing on market inefficiencies.

Furthermore, Gabelli’s commitment to transparency ensures that investors have access to accurate information about their investments at all times. This level of openness builds trust among investors while promoting accountability within the industry as a whole.

As for Gabelli’s influence going forward, it is clear that his contributions will continue to shape how mutual funds are managed and operated. With ongoing advancements in technology and evolving investor preferences, we can expect even greater innovation in this space.

In conclusion (following your instructions), Marc J Gabelli’s impact on the future of mutual funds cannot be overstated. His forward-thinking mindset and relentless pursuit of excellence have transformed an already thriving industry into one poised for continued growth and success.

Conclusion

From humble beginnings to becoming a revolutionary force in the mutual fund industry, Marc J Gabelli has left an indelible mark on the financial world. Through his innovative strategies and unwavering dedication, he has transformed the way investors approach mutual funds.

Gabelli’s contributions to the industry cannot be understated. His introduction of new investment approaches and strategies have not only benefited individual investors but also had a significant impact on the overall financial market. By constantly pushing boundaries and challenging conventional wisdom, Gabelli has paved the way for future advancements in the field.

Through his leadership at Associated Capital Inc and Gamco Investors Inc, Gabelli continues to shape and influence the industry. His keen business acumen combined with his deep understanding of markets sets him apart as one of the most respected figures in finance.

Marc J Gabelli’s success is evident by his numerous achievements throughout his career. From being recognized as Morningstar’s Fund Manager of The Year to being appointed Chairman of multiple companies, he has demonstrated exceptional skill and foresight in navigating complex financial landscapes.

As we look towards the future, it is clear that mutual funds will continue to play a crucial role in investment portfolios worldwide. And thanks to pioneers like Marc J Gabelli, this industry will only evolve further. His influence will undoubtedly inspire new generations of investors and fund managers alike, propelling innovation and growth within this ever-changing landscape.