The key to success in the ever-changing world of financial investments is maintaining an up-to-date knowledge base. The trade value chart is a powerful asset for any investor. In this detailed tutorial, we’ll go over all there is to know about the trade value chart, from the basics to advanced topics like FAQs and a detailed plan for improving your investment strategy.

Trade Value Chart: Unveiling the Basics

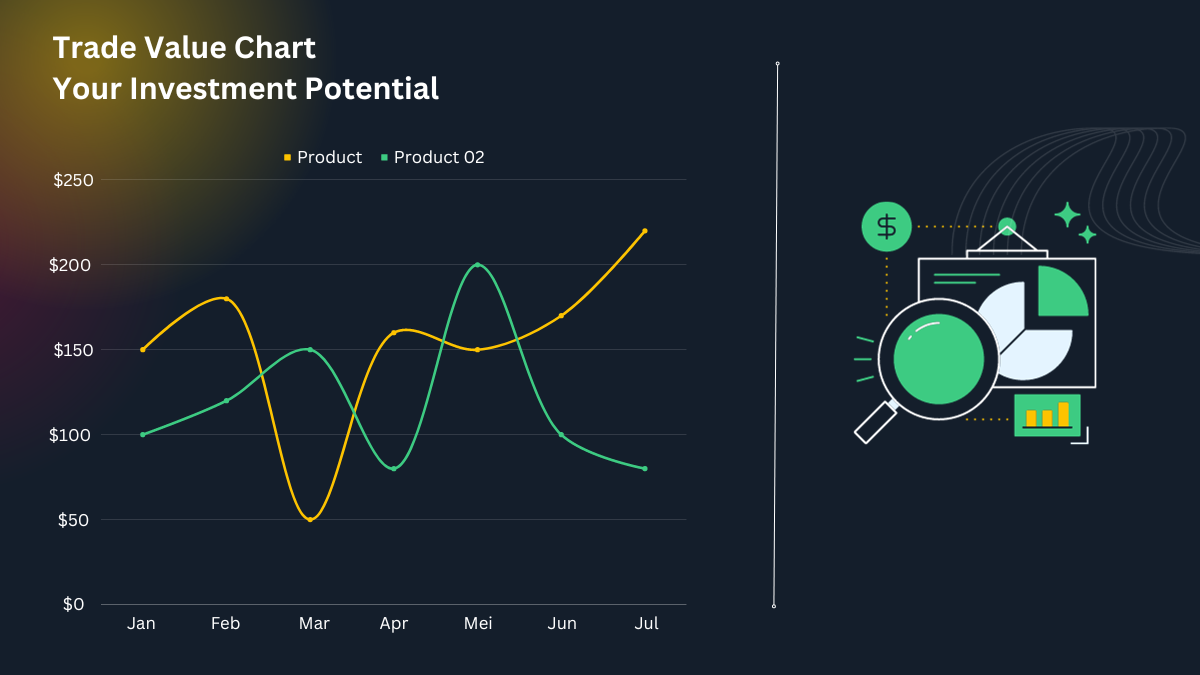

The trade value chart is a useful instrument for comparing and analyzing the worth of various investments. It’s a visual aid for the market that helps traders make smarter choices.

Understanding Trade Value Chart

A trade value chart is a visual representation of an asset’s price dynamics over time. It aids traders in monitoring price changes and anticipating market movements.

Key Components

Several essential parts make up the average chart of trade values:

- Price Trends: Explicitly showing the price changes over a given time period.

- Volume: Displaying the level of activity in the market as measured by trade volume.

- Support and Resistance Levels: Bringing attention to areas where buying and selling pressure tend to concentrate for a certain item.

The Importance of Trade Value Chart

The trade value char’t is an essential tool for any serious investor. Reasons why

· Informed Decision-Making

Insights regarding market movements can be gleaned from the chart, helping investors make smarter choices. The Trade Value Chart is a useful tool for all investors, whether they are seasoned pros or just starting out.

· Risk Mitigation

Risks can be reduced by studying an asset’s past performance. You can minimize your risk by trading based on what you learn from analyzing the trade value chart.

Trade Value Chart in Action

Let’s go into a real-world example to better understand the trade value chart’s potential uses.

Let’s say you’ve got your eye on a specific stock. Its market value can be analyzed by looking at a chart.

- Identify trends: Determine if the stock is moving higher or lower.

- Determine entry and exit points: Determine the best times to buy and sell stock.

- Assess market sentiment: Try to get a feel for how people feel about the asset in general.

Conclusion

Knowledge is power in the world of investments. Your investing potential can be unlocked by analyzing the transaction value chart. You may improve your trading decisions, reduce your exposure to risk, and set yourself up for long-term success by learning to use this potent instrument.

FAQs

How can I access trade value charts?

Trade value charts are readily available on most trading platforms and financial websites. You can also use specialized charting software for in-depth analysis.

What timeframes are commonly used in trade value charts?

Common timeframes include daily, weekly, and monthly charts. The choice depends on your trading style and objectives.

Is it necessary to be a professional trader to use trade value charts effectively?

No, trade value charts are suitable for traders of all levels. Beginners can use them to gain insights, while experienced traders can fine-tune their strategies.

Can trade value charts predict the future performance of assets accurately?

While they can provide valuable insights, no tool can guarantee future performance. Trade value charts are best used as a part of a comprehensive trading strategy.

What are the most common patterns on trade value charts?

Common patterns include support and resistance levels, moving averages, and trendlines. Recognizing these patterns is vital for successful trading.

Are there any free resources to learn more about trade value charts?

Yes, you can find a wealth of free educational content and tutorials online to enhance your understanding of trade value chart’s.