In this piece, we’ll learn about government bonds and why they’re a safe bet for investors. Treasury bonds are a type of government debt security issued for financing purposes. They are favored by people looking for low-risk investments due to the steady income they provide. This article will explore the many varieties of treasury bonds, their advantages and disadvantages, and the risks and rewards of buying them as an investment.

What Are Treasury Bonds?

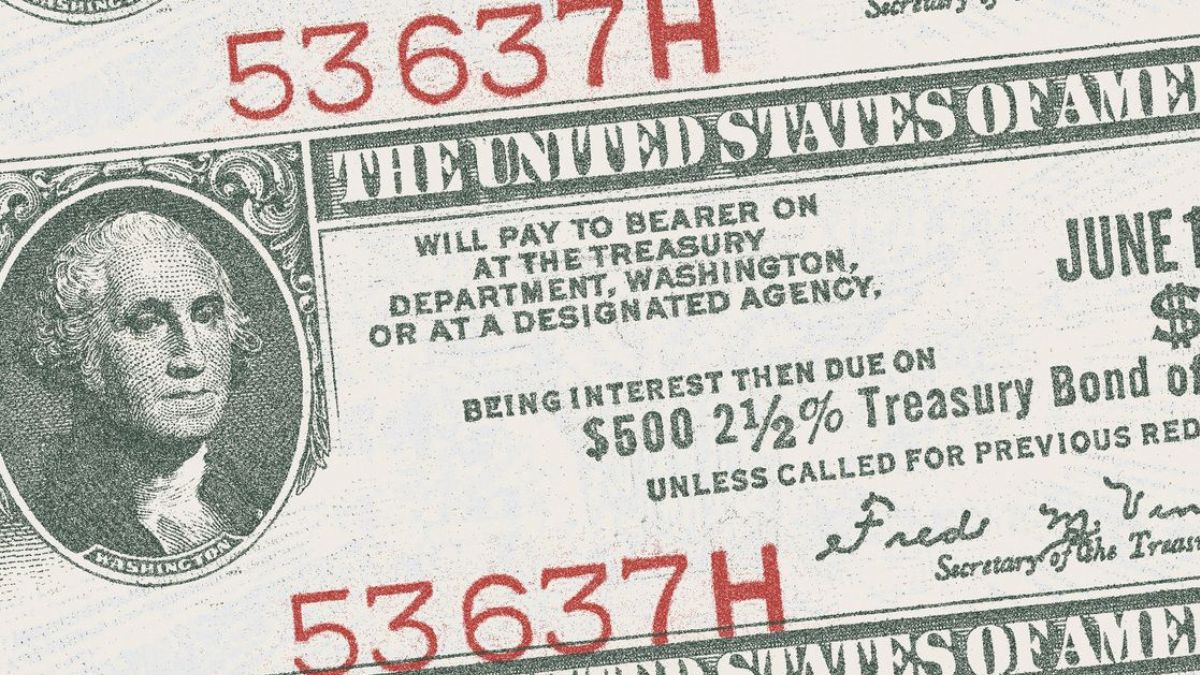

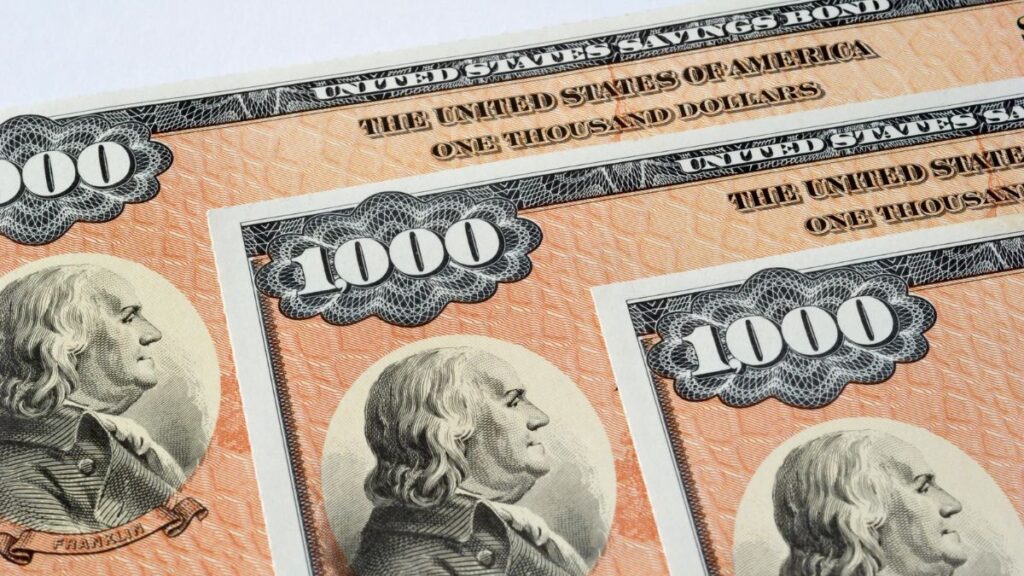

U.S. Department of the Treasury bonds, often known as T-bonds or long-term bonds, are a type of fixed-income security. Bonds have a maturity of ten years or more and pay interest to investors on a regular basis. Bondholders get their initial investment back (face value) once the bond’s maturity date has passed. One of the most secure investments is a U.S. Treasury bond, which is guaranteed by the full confidence and credit of the United States government.

Types of Treasury Bonds

Treasury bonds come in a variety of forms, each of which can be used to meet a specific financial goal. The most typical examples are:

- 30-Year Treasury Bonds: The longest maturing government bonds, offering the greatest interest rates. They are good for investors who want steady returns over a long time frame.

- 20-Year Treasury Bond’s: Investors looking for a compromise between long-term security and frequent access to capital often choose 20-year Treasury bond’s because of their similarity to 30-year bonds and their shorter maturity duration.

- 10-Year Treasury Bonds: Treasury bond’s with a maturity of 10 years are market standards and a popular investment vehicle. They offer a favorable trade-off between risk and return, making them appealing to numerous types of investors.

- 5-Year Treasury Bond’s: Treasury bond’s with a maturity of 5 years are a good option for those who are searching for a moderate rate of return in a shorter time frame.

- 3-Month Treasury Bills: Although treasury bills are not officially bonds, they are government-issued debt instruments with a duration of three months or less. They pose the least amount of risk and are easily convertible into cash, making them perfect for conservative investors and those with immediate cash demands.

Benefits of Investing in Treasury Bonds

There are a number of upsides to buying treasury bond’s:

- Safety and Security: Treasury bond’s are one of the safest investments since they are backed by the United States government. The risk of default is negligible, giving investors confidence.

- Stable Income: Interest on Treasury bond’s is guaranteed and paid on a regular basis, so investors can count on a reliable source of income. That’s why they’re popular among retirees and other investors who need a steady income stream.

- Diversification: Treasury bond’s provide diversification and can be a good complement to a diverse investing strategy. Stability in times of market turmoil is provided by their inverse relationship to riskier assets like stocks.

- Liquidity: The secondary market for Treasury bond’s is very active, making them a very liquid investment option for traders. This gives shareholders the option to withdraw their money whenever they like.

- Tax Advantages: Treasury bond interest is exempt from state and local income taxes, making them attractive to investors in states with high effective marginal tax rates.

Risks Associated with Treasury Bonds

Treasury bond’s have a reputation as a secure investment, but there are still some downsides that you should be aware of.

- Interest Rate Risk: Interest rate risk occurs when the value of Treasury bond’s declines as rates rise. Bond prices decline if interest rates rise, and bondholders who sell their bonds before they mature may incur a loss of principal.

- Inflation Risk: Treasury bond’s face the risk of inflation, which reduces their purchasing power over time. The real rate of return on federal bonds may fall if inflation rates rise sharply.

- Opportunity Cost: When compared to riskier investments like stocks or corporate bonds, the returns on Treasury bond’s are lower. The opportunity cost is the lower return on investment that could have been gained by investing in something else.

- Reinvestment Risk: It is possible that the interest rate available at the time interest payments are reinvested will be lower than the interest rate on the initial government bond. The end result may be a lower return on investment.

Factors Affecting Treasury Bond Prices

Treasury bond prices are affected by several variables, including:

- Interest Rates: Bond prices react immediately to shifts in interest rates. Bond prices fall when interest rates go up, and rise when rates go down.

- Inflation Expectations: Treasury bond yields are responsive to market expectations of inflation. Bond prices could fall if investors want greater returns in anticipation of higher inflation.

- Economic Conditions: The price of treasury bond’s can be affected by macroeconomic factors such as GDP growth, unemployment rates, and inflation rates.

- Supply and Demand: Price swings in treasury bond’s can be attributed to shifts in supply and demand in the bond market. The demand for safe-haven assets among investors and the government’s desire to borrow both have a role.

‘How to Invest in Treasury Bonds‘How to Invest in Treasury Bonds

Treasury bond’s can be purchased through a number of different channels:

- Directly from the Government: You can buy treasury bond’s straight from the government using the TreasuryDirect website, which is operated by the United States Department of the Treasury. This approach provides ease and availability.

- Through Brokerage Firms: Investors can purchase and sell treasury bond’s using a brokerage account at one of the many companies that provide this service. Investors can receive further assistance and services through this choice.

- Exchange-Traded Funds (ETFs): Treasury bond exchange-traded funds Treasury bond exposure can be obtained through exchange traded funds. They facilitate individual investors’ entry into the bond market through their trading on stock exchanges.

- Mutual Funds: Bond mutual funds pool capital from multiple participants and invest it in a wide range of bonds, including U.S. Treasury securities. They provide ease of use and knowledge thanks to their professional management by fund managers.

Tax Considerations for Treasury Bond Investors

Investors in government bonds need to be mindful of the tax consequences:

- Federal Taxes: Treasury bond interest is taxable by the federal government but not by individual states. Interest earned on bonds is taxable income for U.S. citizens and permanent residents.

- Tax-Advantaged Accounts: Investors who buy treasury bond’s in tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k) plans can postpone paying taxes on the interest income until the time it is withdrawn from the account.

- Tax Planning: When investing, it’s important to consider the tax implications and work with a tax expert to develop a plan that minimizes those costs.

Comparison with Other Investment Options

It is important to evaluate Treasury Bond’s alongside other investment possibilities, such as:

- Stocks: Treasury bond’s are a safer alternative to stocks because of the steady income they give. Long-term, however, the returns on stocks have the potential to be larger, albeit at a higher risk.

- Corporate Bonds: Default risk is higher for corporate bonds than it is for treasury bond’s. Potentially higher yields could be offset by greater credit risk. Investors need to consider their risk appetite and long-term investing goals.

- Savings Accounts: Treasury bond’s often give larger returns than savings accounts. They offer monthly interest payments in addition to the possibility of capital appreciation.

- Real Estate: Investment property offers diversification and the possibility of capital appreciation. However, there are dangers involved, such as market volatility and property management, that necessitate active management.

Strategies for Maximizing Returns on Treasury Bond’s

The following are some tactics that can help you get the most out of your Treasury Bond investments:

- Ladder Strategy: Bond ladders are constructed by purchasing bonds with varying maturities. This method can be used to hedge against fluctuations in interest rates while maintaining a steady flow of revenue.

- Bond Fund Allocation: Allocating a portion of your investing portfolio to bond funds, such as treasury bond funds, can help you diversify your holdings and get your money managed by experts.

- Yield Curve Analysis: The yield curve can be analyzed to learn about future interest rate projections. The yield curve allows investors to make strategic bond portfolio adjustments.

- Reinvestment Planning: Optimization of returns can be achieved through deliberate planning of the reinvestment of interest payments and bond revenues. In order to make the best reinvestment choices, it is essential to analyze the current interest rates and available investments.

Historical Performance of Treasury Bonds

Treasury bond’s have always been a reliable source of income and capital preservation during periods of market uncertainty. Their results have been affected by the economy and interest rates at the time. Investors should do their homework and think carefully about their financial goals before making any investment decisions, since previous performance is no guarantee of future outcomes.

Conclusion

If you’re looking for a safe and steady source of income, Treasury bond’s are a great alternative. Treasury bond’s are backed by the United States government and provide a low risk, making them a good choice for anyone looking for a stable income, diversification, or tax breaks. However, inflation and interest rate fluctuations pose dangers that investors must take into account. Individuals can make educated judgments about whether or not to incorporate treasury bond’s in their investing portfolios by learning about the different types of treasury bond’s, factors influencing their prices, and acceptable investment strategies.

Frequently Asked Questions

Are treasury bonds risk-free?

While treasury bond’s are considered low-risk investments, they are not entirely risk-free. They are subject to interest rate risk and inflation risk.

Can I sell treasury bond’s before they mature?

Yes, treasury bond’s can be sold before maturity in the secondary market. The price at which they can be sold will depend on prevailing market conditions.

How often are treasury bond interest payments made?

Treasury bond interest payments are typically made semi-annually, although some bonds may have different payment frequencies.

Are treasury bonds suitable for short-term investments?

Treasury bond’s are generally more suitable for long-term investments due to their longer maturity periods. Short-term investment needs can be better served by treasury bills or other short-term fixed-income instruments.

What is the minimum investment required for treasury bond’s?

The minimum investment for treasury bond’s is typically $100, although certain brokerage firms or investment platforms may have their own requirements.