In the past decade, Wells Fargo Bank has been one of the most frequently scrutinized financial institutions in the United States. Its long-standing reputation for consumer trust was severely tested by a series of high-profile scandals, leading to billions of dollars in fines, lawsuits, and consumer restitution. As of 2025, new settlements, consumer payout phases, and regulatory mandates have reshaped the landscape of how financial institutions operate, with Wells Fargo standing at the center of banking reform – Wells Fargo Bank Settlement Details.

This article provides a comprehensive, 3000-word breakdown of the most recent Wells Fargo settlement details, examining the evolution of legal action, the current status of customer reimbursements, and what the future looks like for both the bank and the people it serves.

The Background: How Wells Fargo’s Legal Troubles Began

Wells Fargo’s legal and regulatory troubles can be traced back to a 2016 revelation that employees had created millions of unauthorized accounts in customers’ names. This act was driven by aggressive sales targets and internal pressure to meet unrealistic performance metrics. The scandal triggered widespread public backlash and resulted in the firing of thousands of employees, resignations of senior executives, and a $185 million fine from the Consumer Financial Protection Bureau (CFPB), the Office of the Comptroller of the Currency (OCC), and the Los Angeles City Attorney – Wells Fargo Bank Settlement Details.

Yet that was only the beginning.

Subsequent investigations revealed a broad pattern of misconduct in auto lending, mortgage services, insurance product sales, and wealth management. These revelations led to a multi-year regulatory and legal overhaul of the bank’s internal processes and how it interacts with customers.

Key Settlements Through 2025: A Timeline of Legal Resolution

While the early settlements laid the foundation for regulatory scrutiny, the most substantial progress has been made in the years following 2020. The following is a detailed account of major settlements leading up to and including 2025:

1. 2020: $3 Billion DOJ & SEC Settlement

In February 2020, Wells Fargo agreed to pay $3 billion to settle criminal and civil investigations with the Department of Justice and the Securities and Exchange Commission. This settlement included a deferred prosecution agreement and addressed the bank’s role in misleading investors and customers about its sales practices.

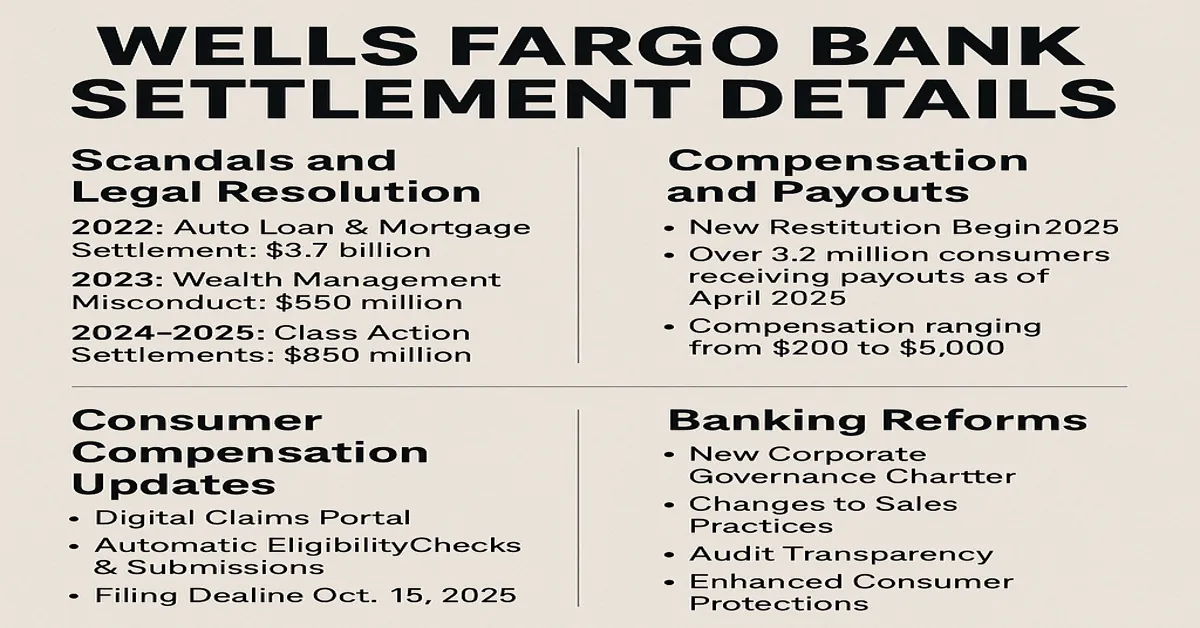

2. 2022: Auto Loan & Mortgage Scandal – $3.7 Billion

This record-breaking settlement with the CFPB included $2 billion in customer restitution and $1.7 billion in civil penalties. It related to wrongful repossessions, illegal fees, and unjustified foreclosure processes on home loans.

3. 2023: Wealth Management Misconduct – $550 Million

Wells Fargo paid this sum to settle claims that it misled investors, particularly elderly clients, into purchasing high-fee investment products that didn’t align with their risk profiles.

4. 2024-2025: Class Action Settlements – $850 Million

This series of class action lawsuits addressed grievances from customers who experienced negative credit reporting, denied mortgages, and lost vehicles due to unjust repossession. These cases were consolidated in federal court, resulting in the largest coordinated consumer settlement in Wells Fargo history.

2025 Settlement Milestones: What’s New and What Consumers Need to Know

New Restitution Program Launched in Q1 2025

Wells Fargo began rolling out a new restitution program in March 2025. This program automates customer compensation based on transaction and service history using machine learning algorithms vetted by a third-party compliance agency – Wells Fargo Bank Settlement Details.

Key Features:

- Digital Claims Portal: Customers can now log in to a dedicated Wells Fargo Claims Portal to verify eligibility.

- Auto-Eligibility Checks: The system checks past accounts for discrepancies in mortgage handling, car loans, and service fees.

- Phased Payouts: Payments are being distributed in waves, starting with impacted customers from 2011–2015.

Amounts Being Paid to Consumers

As of April 2025:

- Over 3.2 million customers have received individual payouts ranging from $200 to $5,000 depending on the severity and duration of the harm.

- Approximately $120 million has been disbursed in the first wave alone.

- Additional $180 million will be distributed by Q4 2025.

How to Check Your Eligibility for a Settlement

If you’re a former or current Wells Fargo customer and think you may be entitled to compensation, here’s how to check:

- Visit the Official Portal: The bank’s official settlement portal is accessible from its homepage or at www.wellsfargosettlement2025.com.

- Submit Your Info: Enter your name, past account number(s), and SSN (last 4 digits only).

- Review Status: Eligible users will receive a confirmation number and email follow-up.

- Receive Funds: Payments are direct-deposited or mailed via check.

Customers have until October 15, 2025, to file claims or appeals.

Regulatory Oversight and Reforms in 2025

Beyond financial penalties, Wells Fargo has been subject to strict regulatory oversight. Here are reforms mandated by federal regulators:

1. New Corporate Governance Charter

Wells Fargo was ordered to overhaul its board composition. As of January 2025:

- 4 new independent directors were appointed.

- A Chief Ethics Officer now reports directly to the board, bypassing executive management.

2. Sales Practice Reforms

The aggressive cross-selling practices that originally led to the scandals have been dismantled.

- Sales incentives are no longer based on account volume.

- Employee compensation is tied to service quality and customer satisfaction.

3. Audit Transparency

Wells Fargo must now publish quarterly audits of customer claims processing, reviewed by an external regulatory monitor.

4. Consumer Protections

- All high-fee investment products now require a third-party review.

- Customers must be given 30-day notice before credit reporting changes are made due to internal errors.

The Impact on Wells Fargo’s Brand and Business

The cumulative impact of the scandals and the resulting settlements has been enormous, both financially and reputationally. In early 2020, Wells Fargo was the fourth-largest bank in the U.S. by assets. As of 2025, it remains in the top five but has lost a substantial chunk of market share in several segments, including mortgage lending and wealth management.

However, its 2025 annual shareholder report showed signs of resilience:

- Customer Retention: 78% of retail banking customers have remained loyal, citing satisfaction with new transparency measures.

- Digital Banking Usage: Online and mobile banking engagement rose by 12% in Q1 2025.

- Employee Satisfaction: Internal surveys show a 40% increase in employee morale due to improved workplace ethics and new HR policies.

Public Response and Media Coverage

The settlements and reforms have drawn mixed reactions from the public:

- Positive: Many customers feel vindicated and supported by the compensation and transparency.

- Negative: Some consumer advocates argue that the payouts don’t match the emotional and financial damage caused.

Media outlets have highlighted stories of individual recovery:

- A retired teacher in Colorado received $3,200 for a wrongful foreclosure dating back to 2013.

- A small business owner in Florida recovered $1,800 due to improperly assessed overdraft fees.

The Broader Impact on the U.S. Banking Sector

The Wells Fargo saga has become a case study in corporate accountability. Several key outcomes are affecting the entire industry:

- Stricter Compliance Across All Major Banks: Institutions like JPMorgan Chase and Bank of America have implemented new oversight panels to avoid a similar fate.

- Increased Consumer Awareness: Customers are now more vigilant, regularly checking their credit reports and scrutinizing bank statements.

- Regulatory Empowerment: Agencies like the CFPB have received increased funding and authority, especially around whistleblower protections and corporate compliance.

Future Outlook: Can Wells Fargo Fully Recover?

While 2025 marks a major turning point in Wells Fargo’s corporate history, full rehabilitation of its brand is still in progress. Recovery depends on the bank’s ability to maintain ethical consistency, rebuild trust, and avoid future missteps.

The bank has launched a public awareness campaign titled “Banking With Integrity,” featuring real customer stories and employee interviews about changes inside the company. Additionally, Wells Fargo has committed to investing $1 billion into community programs, financial education, and affordable housing over the next five years.

Final Thoughts

The Wells Fargo settlement details of 2025 highlight a painful but transformative period for one of America’s largest banks. While monetary compensation is only part of the healing process, the real story lies in the bank’s efforts to rebuild its culture, prioritize transparency, and restore faith in the financial system.

For consumers affected by the scandal, the message is clear: your voice matters, your financial rights are protected, and restitution—however delayed—is still achievable.