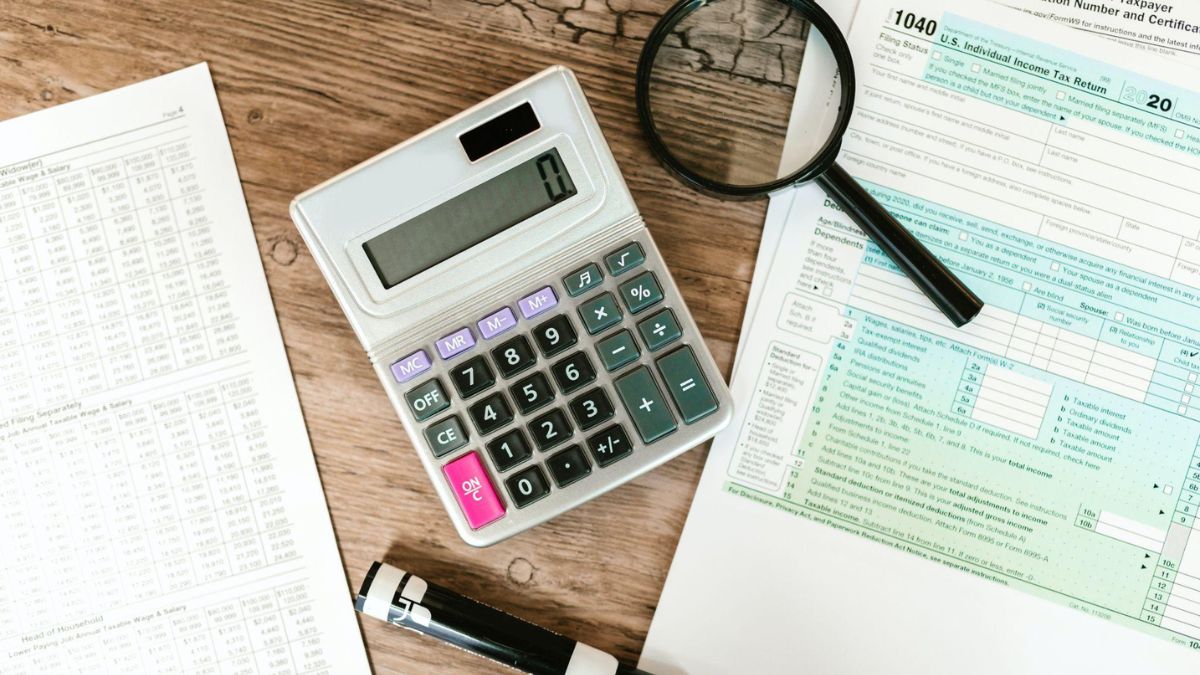

The IRS, often painted as the villain in the eyes of many taxpayers, actually offers various relief programs to help individuals struggling with back taxes. Among these, the Offer in Compromise (OIC) stands out as a beacon of hope for those drowning in tax debt. The OIC program allows taxpayers to settle their tax debt for less than what they owe, making it an invaluable tool for many who find themselves in financial distress.

If you’re grappling with overwhelming tax debt, it’s essential to understand the benefits of the OIC program to determine if it’s the right fit for your situation. Here are the top benefits of availing the Offer in Compromise:

A Fresh Start To Your Financial Journey

The primary allure of the OIC program is its promise of a fresh start. Allowing taxpayers to clear their outstanding tax debt for a fraction of what they owe, provides an opportunity to start anew, free from the chains of previous financial mistakes. It’s akin to hitting the reset button on your financial life.

And speaking of fresh starts, for more on the fresh start program, check this website. The OIC program stands as a testament that the IRS is not just about collection; it’s also about providing viable solutions for taxpayers in genuine distress.

Avoiding Severe Collection Actions

Without a doubt, owing the IRS money can be daunting. When you’re unable to pay your tax debt, the IRS can take severe collection actions, including garnishing your wages, levying your bank accounts, or even seizing your property.

By accepting an OIC, you can avoid these drastic measures, ensuring that your assets remain intact and you can continue your day-to-day life without the constant threat of the IRS looming overhead.

Flexibility In Payment Terms

One of the standout features of the OIC program is the flexibility it offers in terms of payment. Depending on your financial situation, the IRS might allow you to make lump sum payments or pay in installments.

This flexibility ensures that even if you’re settling for a reduced amount, the payment terms won’t push you further into financial hardship.

Elimination Of Penalties And Interest

Tax debt can quickly snowball, thanks to the penalties and interest that the IRS adds for late payments. Over time, these additions can make the original amount owed seem minuscule in comparison.

With an accepted OIC, not only can you reduce your principal tax debt, but in many cases, the penalties and interest accrued will also be included in the settlement amount, preventing them from further exacerbating your financial woes.

Mental Peace And Reduced Stress

The emotional and mental toll of having a significant tax debt cannot be understated. The constant worry about impending IRS actions, coupled with the weight of financial burden, can lead to severe stress, anxiety, and even depression.

By taking advantage of the OIC program, you can alleviate this mental strain, knowing that your tax troubles are being addressed and resolved.

Boost To Credit Health

Unresolved tax liens can have a detrimental effect on your credit score, making it challenging to secure loans, mortgages, or even some job positions.

Successfully negotiating an OIC and paying off the agreed-upon amount can lead to the removal of the tax lien, paving the way for improved credit health and opening doors to future financial opportunities.

Finality To Your Tax Problems

With the acceptance of an OIC, you’re provided with a clear path to resolution. No more ambiguous future, no more dreading every piece of mail from the IRS, and no more endless anxiety about how and when your tax situation will be resolved.

The OIC program offers a definitive end to your tax problems, allowing you to move forward with clarity and confidence.

In Conclusion

The Offer in Compromise program, while not suitable for everyone, offers a lifeline to those genuinely struggling with insurmountable tax debt. By understanding the myriad of benefits that the program offers, you can make an informed decision about whether it’s the right solution for your situation.

Remember, facing tax debt head-on and seeking resolution, whether through the OIC or another IRS program, is always better than ignoring the problem and hoping it goes away. By taking proactive steps and leveraging the tools available, you can navigate your way to a brighter financial future.